Contents

Introduction

The economy is a system in which all the economic agents are interdependently working and doing their respective economic activities. It means consumers are involved in buying goods and services, producers are producing and selling goods and services, and the government is there to become part of such transactions, as well as for control mechanisms. In carrying out such economic activities there are different flows like the flow of goods and services, factors of production, factor payment, payment for goods and services, etc. These flows of products, factor inputs, payment for products, and payment for factors of production create a macroeconomic circular flow model.

Meaning of Circular Flow Model

The circular flow is an economic model or tool used to show the continuous movement of output and input/factors of production, money payment, and received in buying and selling of output and inputs between producers, resource suppliers, and consumers.

In another word, the circular flow of economic activities is defined as the flow of payments and receipts for goods and services, and factor services between different sectors/actors/agents of an economy. It shows the regular flow of products, factors, and money received and paid among the household, business, government, and foreign sectors through the product, resource/factor, and financial markets.

“A circular flow diagram is a simplified representation of the macroeconomy. It shows the flow of money, goods, and services, and factors of production through the economy.” – Paul Krugman.

Major Sectors/Actors in the Circular Flow Model

- Household Sector: Responsible for consumption expenditure- Consumption

- Business Sector: Responsible for investment expenditure-Production

- Government Sector: Responsible for government purchases and regulation in the economy

- Foreign Sector: It ensures the component called net export- external economic activities.

Types of Flows in Circular Flow Model

The Physical/Real Flow

The flow of goods and services as well as factors between household, business, government, and foreign sectors.

The Monetary Flow

The flow of money income from the household to the business sector and from the business sector to the household sector.

Markets to Interact in Circular Flow Model

- Product/Output Market: In this market consumer goods and services are bought and sold.

- Input/Factor Market: In this market resources are purchased and sold.

- Financial Market: In this market, short-term and long-term lending and borrowing activities are carried out.

Types of Circular Flow Model

- Two Sector Circular Flow Model: It includes household and business sector

- Three Sector Circular Flow Model: It includes household, business sector, and government sector

- Four Sector Circular Flow Model: It includes household, business sector, government sector, and foreign sector

Two-Sector Circular Flow Model

The circular flow model in the two-sector closed economy is a hypothetical concept that states that there are only two sectors in the economy, the household sector, and the business sector (business firms).

The household sector is the source of factors of production that earn by providing factor services to the business sector. The business sector refers to the firms that produce goods and services and receive income by supplying the produced goods to the household sector.

The circular process begins with the flow of economic resources from households to firms to produce and the flow of money to households in the form of factor income and again money flows from households to firms as consumption expenditure made by the households.

Two Sector Circular Flow Model: Assumptions

- There are only two sectors in the economy: the household sector and the business sector.

- No government interventions over the economic activities.

- There is an absence of import and export by the business sectors

- Households are the owner of factors of production.

- Firms employee factor services.

- The financial sector only plays the role of intermediary to convert the savings of the household into investment.

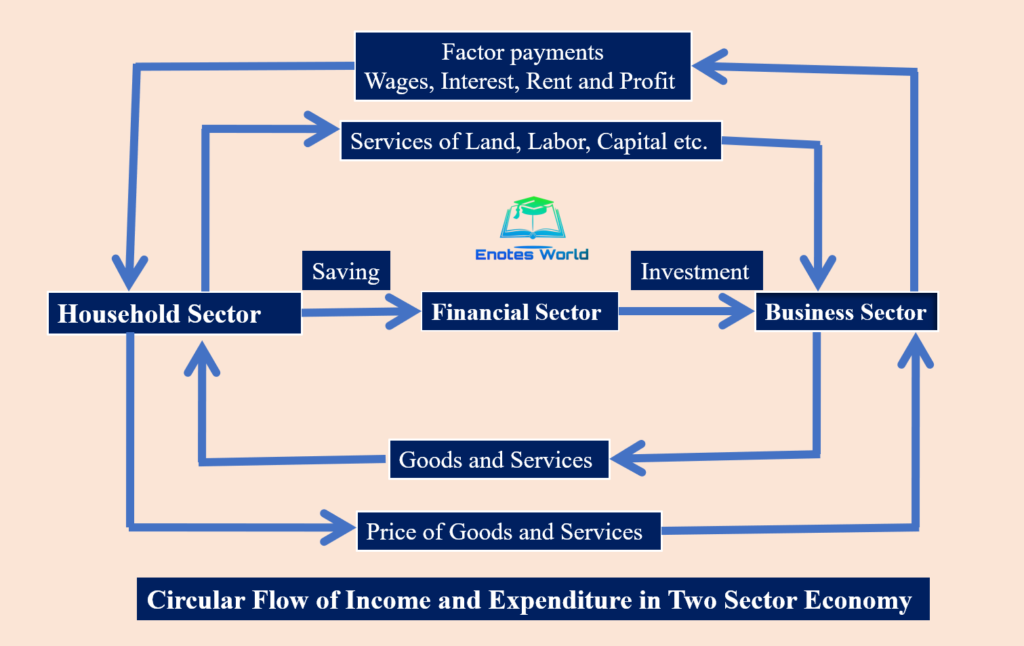

Based on the above assumptions, the two-sector circular flow model can be further explained with help of the following diagram.

The diagram is showing the continuous circular flow of income and expenditure in a two-sector economy. From the figure, it is clear that factor services and money flow in the opposite direction. That means real flow and money flow move in opposite directions in the case of the two-sector circular flow model.

In the upper half of the figure, there is the flow of factors of production from the household sector to the business sector as a real flow. And this makes the counter flow of factor pavements in the form of rent, wages, interest, and profit to the household sector from the business sector as monetary flow.

Similarly, the lower part of the figure shows the product market. In the product market, there is the flow of goods and services to the household sector from the business sector as real flow and in return, the household sector makes the flow of price paid to the business sector as monetary flow. Excess funds of the household sector move to the financial market in the form of savings and that would be borrowed by the business sector and converted into investment.

By combining these two parts, we will get the continuous circular flow of income and expenditure in a two-sector economy.

Three-Sector Circular Flow Model

The three-sector circular flow model includes the government sector along with the household and business sectors. Thus, in the three sectors circular flow macroeconomic model the three major economic agents the household, business, and the government sector play in the economy. Although the three-sector circular flow model includes the government, it is still assumed to be a closed economy where the income flow is not influenced by any foreign sector.

In this model, along with the income and expenditure of the households and business firms, government purchases or expenditures and taxation also come into play. Here, government purchases are injections into the circular flow, while taxation is a leakage.

Firstly, considering the flow of income and expenditure between the household sector and the government, the household sector pays income tax and commodity tax to the government. Similarly, the government put up transfer payments to the household sector in several forms of benefits such as pension funds, relief, sickness benefits, health, education, and other services.

The flow of income and expenditure between the business sector and the government is similar. Taxation is paid by the business firms and the government offers different forms of production subsidies, makes transfer payments and makes the payment for the goods and services it purchases from the business sector.

Here taxes paid by the household and the business sector are the leakages from the circular flow. This decreases not only the consumption and savings of the household sector but investments and production of the business sector also. The government however compensates for the leakages by purchasing services from the household sector, and goods and services from the business sector. This leads to an equilibrium in the circular flow as the level of demand meets the level of supply in the economy.

A certain portion of the income earned by the government may be saved and deposited in the financial and capital market. The government also takes loans from the capital market either to meet the current expenditure or to invest in different projects.

Assumptions

- The whole economic activities are organized into three major sectors: household, business, and government.

- The economy is closed and there is no foreign trade.

- Government affects the economy by using taxation, transfer payments, and business subsidy.

- Household and business sectors pay taxes to the government.

- There is the existence of perfect competition.

- There is a well-managed financial market.

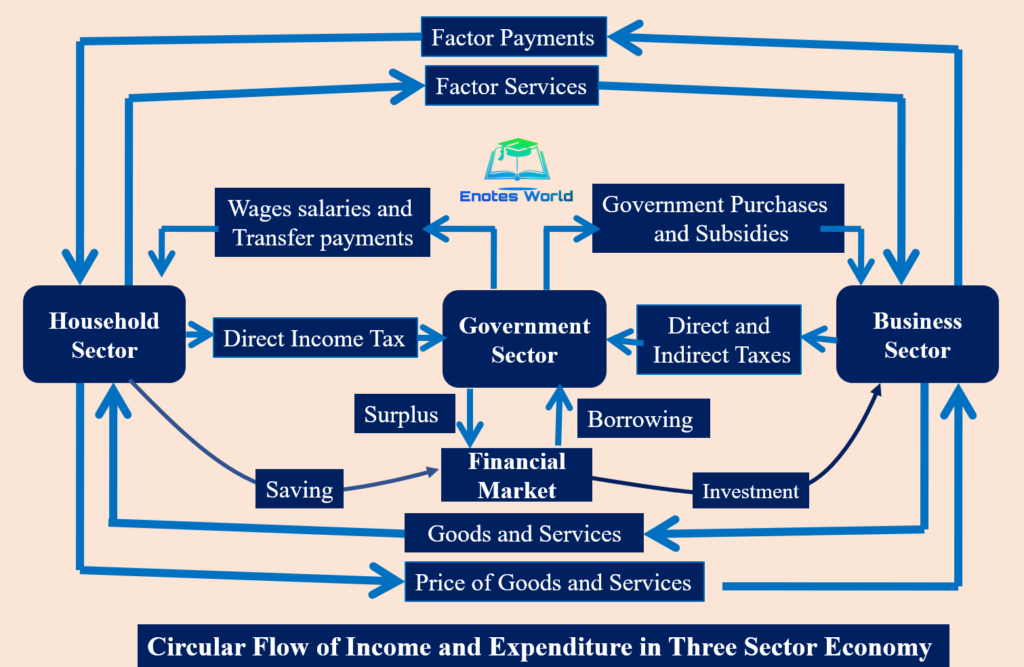

Based on the above assumptions, the three-sector circular flow model can be further explained with help of the following diagram.

The three-sector circular flow model is formed by adding the government sector to the two-sector model.

In the upper half of the figure, it can be observed that households are getting paid for their factor services and the government receives direct taxes from the households. Likewise, the government levies both direct and indirect taxes on business firms. The total sum of direct and indirect taxes is the revenue of the government. The government spends this revenue which is received by the households in the form of wages, salaries, and transfer payments, and business firms as the payment of goods and services and subsidies.

Four-Sector Circular Flow Model

The circular flow model in four sector economy provides a realistic picture of the circular flow in an economy. Four sector model studies the circular flow in an open economy which comprises the household sector, business sector, government sector, and foreign sector.

The foreign sector consists of net export. Net export is the difference between export and import (X-M). Hence it is also called an open economy and it consists of two kinds of international transactions.

Foreign trade

Flow of capital

In the present time of globalization, economies of the world are being increasingly open and interconnected. Thus, the foreign sector has an important role in the economy. When domestic business firms export goods and services to foreign markets, injections are made into the circular flow model. On the other side, if the national businesses or the government imports from overseas corporations and firms, leakage appears in the circular flow model.

Assumptions

- The whole economic activities are organized under four distinct economic sectors: household, business, government, and foreign sectors.

- Household supply resources to domestic and foreign firms, they obviously supply resources of production to the homeland government.

- It is an open economy.

- The external sector includes exports and imports of goods and services produced by the firms.

- The household sector exports labor and capital only.

- There is minimal government intervention.

- There is perfect competition in both internal and external markets.

- There is a well-managed financial market.

- Business firms export and import only goods and services.

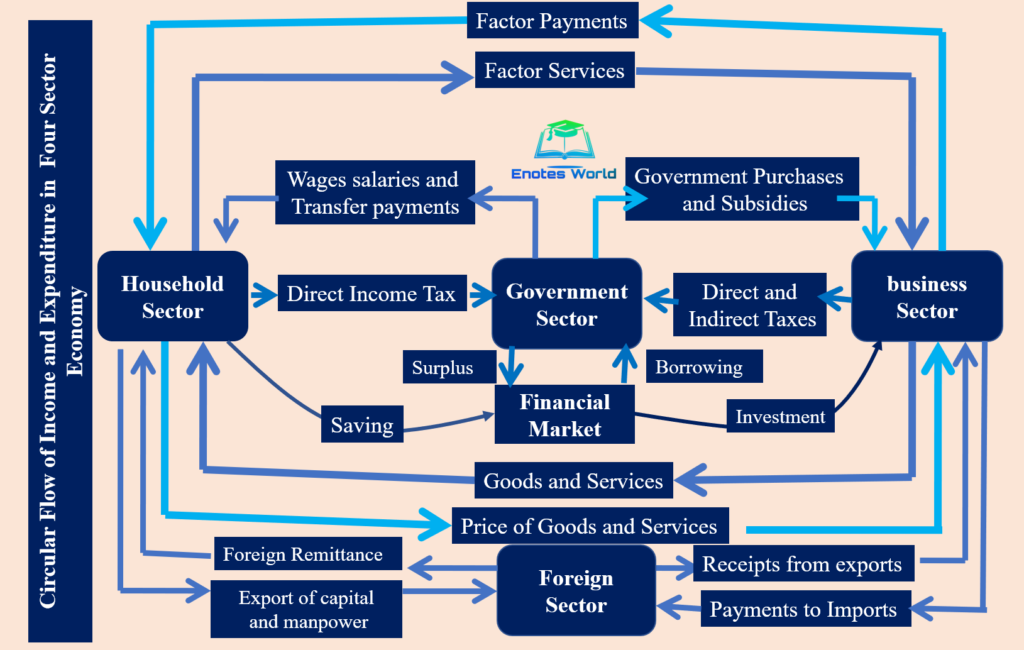

Based on the above assumptions, the four-sector circular flow model can be further explained with help of the following diagram.

Households supply resources to the domestic business and government sector. They receive income from firms and the government, purchase goods and services from firms, and pay taxes to the government.

They also purchase foreign-made goods and services (imports). In today’s increasingly globalized world households particularly supply labor services to foreign countries also and they receive remittance income. They also invest their capital in foreign countries and receive profit income.

The business receives payments from households and the government for goods and services; they also sell their output to foreigners (export) and receive revenue; they pay wages, dividends, interest, and rents to households and taxes (indirect taxes and corporate profit taxes) to the government. It also imports goods and services from the rest of the world (Row). Thus, the business sector pays for imports it made and receives from the exports that it made to foreign countries.

The government receives taxes from businesses and households (households pay income and property taxes). It pays businesses and households for goods and services including wages to government workers. It also pays interest and transfers payments (e.g. old age allowances, unemployment allowances, pension of retired government workers) to households.

The government provides subsidies to the business sector. Government produces public goods like national security, streetlights, and social overhead capital for instance public highways, telecommunication, hydropower generation, etc.

Connecting the domestic economy to the foreign economy, people from other countries purchase goods and services produced domestically. This is the export trade component of the domestic economy. Similarly, domestic citizens also purchase (import) foreign-made goods and services.

In the overall analysis of the foreign sector, the value of total export minus the value of total imports is required to measure net exports. If the value of imports exceeds that of exports, we say that there are negative net exports and there is a foreign trade deficit. To cover the foreign trade deficit the country must borrow from the rest of the world (Row), invite more foreign direct investment (FDI), or sell more domestic assets to foreigners.

Therefore, we can say that in four sector circular flow model, there are different channels of linkage of the domestic economy with the foreign economics or the Row sector through exports of goods and services, imports of goods and services, inflow and outflow of human labor, inflow, and outflow of financial capital and physical capital.

Leakages and Injections in Circular Flow Model

Leakages and Injections play a vital role in the operation of the circulation flow model. The presence of leakages and injections in the circular flow model makes it inconsistent. Leakage refers to the divergence of income or capital from the economic circulation and injection refers to the addition of income and capital into the circular flow model.

When there is leakage, the volume of income flow decreases, and when there is an injection in the economy the income flow increases. Leakages occur when households withdraw money from the circular flow model and reduce the consumption of goods and services.

The major forms of leakage or the sources of leakage in the circular flow model as listed below.

Saving

It is the portion of income not used by the household to purchase goods and services or pay taxes. Saving is kept with the banks and financial institutions and further that can be lent by the banks to the firms for investment or capital formation.

Taxes

It is the income paid by households and business firms to the public authority. This payment made by households and businesses also reduces income from the circular flow model.

Imports

It is the amount of money paid by domestic businesses to the foreign sector for goods and services purchased from them. Import also causes the outflow of income from the domestic economy.

Total leakage from the economy can be obtained by adding the amount of savings, tax payments, and payments for imports.

Thus, leakages deduce the amount of income from the circular flow of income.

Leakages = S + T + M

Here S stands for saving; T stands for taxes, and M stands for imports

Injections

Injections refer to an increase in the flow of income in the circular flow model. Investment, government spending, and exports are considered the form of forms of injections. Any form of injection increases the volume of income in the circular flow. Mainly there are three forms of injection and these are briefly explained below.

Investment

It is one of the forms of injections in the circular flow model and investment is the total expenditure made by the business firms on capital goods. In the simple sense, investment is an addition to capital stock. It helps to add flows of goods into the market.

Government Expenditure

This form of injection includes the total expenditure made by the government on the purchase of goods and services, subsidies to the business firms, and transfer payments to the members of the household sector. The government payments like social security payments, pensions, allowances, retirement benefits, and temporary aid to needy families, etc. are examples of transfer payments.

Exports

It is another form of injection in the circular flow model and it involves the payment made by the foreign sector for the purchase of goods and services produced by domestic firms. It also adds to the inflow of income to the domestic circular flow model with help of the well-established financial system.

Therefore, injections refer to the addition of income and resources into the circular flow model. The summation of investment, government spending, and export earning gives the total value of injections in the circular flow model.

Injections = I + G + X

Here I stands for investment, G stands for government expenditure, and X stands for exports.

The equality between leakages and injections in the open economy ensures

S + T + M = I + G + X

Or (S –I) = (G – T) + (X – M)

As shown above, leakages are if exactly equal to injections the circular flow of an economy will be in a balanced state. If injections exceed leakages, the national income of the country will be increased. On the other side, if leakages exceed the injections, the country’s national income will be declined.