Contents

Introduction to Concepts of National Income at Factor Cost

Factor cost is the total cost of production. It means factor cost is the total payment made by producers to the owners of factors of production in return for their assistance in the production of goods and services. So, it is the total of all earnings received by factors of production in terms of wages and salaries, rent, interest, and profit. Factor cost is also known as producers’ costs or pure cost of production.

If the values of different concepts of national income are determined at the price that producers pay to the owners of factors of production while producing goods and services, then the concepts are said to be measured at factor cost. Here we try to explain the meaning of different concepts of national income (GDP, NDP, GNP, and NNP) measured at factor cost/producer’s price.

The measurement of the value of various concepts of national income at factor cost does not account for indirect tax and subsidies. Thus, concepts of national income at factor cost are related to the pure cost of production or the pure amount of receipt that owners of inputs received.

Gross Domestic Product at Factor Cost (GDP at FC)

If GDP is measured considering all the payments made to the owners of factors of production in the form of wages and salaries, rent, interest, profit, etc. in return for their contribution to the production of goods and services then it is known as a measure of GDP at factor costs.

So, if income earned by all the productive factors of production located inside the geographical territory of a nation is added then the value of GDP at factor costs is obtained.

Features of GDP at FC

- GDP at factors costs is obtained by considering factor income earned by domestic as well as foreign factors of production operating inside the country

- It measures the whole performance of an economy in terms of factor income

- GDP at factor cost also shows the earning capacity of factors of production and it is always helpful to analyze the productivity of domestic as well as foreign factors of production.

- A higher value of GDP at factor cost with a greater contribution of foreign factors may be problematic in the long run as it may create the problem of dependency and there is always a risk of foreign domination in the economy.

The measurement of GDP at factor cost can be shown with help of the following expression.

GDP at FC = Compensation to Employees (COE) + Operating Surplus (OS) + Mixed-Income from Self-Employment +Depreciation

Where Compensation to Employees (COE) is the summation of payment made by employers to the employees in the form of cash and kind. So, it is made of wages and salaries, bonuses, allowances, commissions, the value of different facilities like medical, education, insurance, accommodation, etc, and the employer’s contribution to social security or social insurance.

Operating Surplus (OS) is the total property income including rent, interest, and profit. So, operating surplus is the summation of interest, rental income, and profit or corporate income. Here corporate income or profit includes corporate income tax, dividends, and undistributed profit or retained earnings.

Mixed-income is income earned from combined and non-specialized or non-separable occupations. So, mixed-income may include income earned from farming enterprises, sole proprietorship income, and other professions like the legal and medical profession, consultancy services, trading, and transportation, etc.

Depreciation entails the wear and tear costs of fixed capital.

Net Domestic Product at Factor Cost (NDP at FC)

If the amount of net domestic product is calculated as the sum total of price compensated to all the factors of production in the form of wages and salaries, interest, rent, and profit for their contribution to the production of goods and services then it is known as a net domestic product at factor cost. It is also calculated by reducing depreciation from the gross domestic product at factor cost. Symbolically it can be expressed as.

NDP at FC = GDP at FC – D

or

NDP at FC = Compensation to Employees + Operating Surplus + Mixed-Income from Self-Employment

Gross National Product at Factor Cost (GNP at FC)

GNP at factor cost is the sum of total factor earnings received by the owners of factors of production in the form of wages and salaries, rent, interest, and profit as a result of their contribution to the production process inclusive of net factor income from abroad (NFIA) during a certain time.

So, GNP at factor cost considers factor income earned by all the owners of factors of production of a nation whether they are operating inside the country as well as outside of the country. It means it is the total earning of national factors of production from their productive contribution. Symbolically it can be expressed as.

GNP at FC = GDP at FC + NFIA

or

GNP at FC = NDP at FC + D + NFIA

Net National Product at Factor Cost (NNP at FC)

Gross national product after allowing for depreciation becomes a net national product. It can be defined as all income earned by the factors of production in the form of factor payments along with net factor earning from abroad after allowing for depreciation. NNP at factor cost itself is the national income of a nation. Thus, it is the total earnings of all factors of a nation in the form of wages and salaries, profit, interest, and rent plus net factor income from abroad. Symbolically it can be expressed below.

NNP at FC = GNP at FC – D

or

NNP at FC = NDP at FC + NFIA

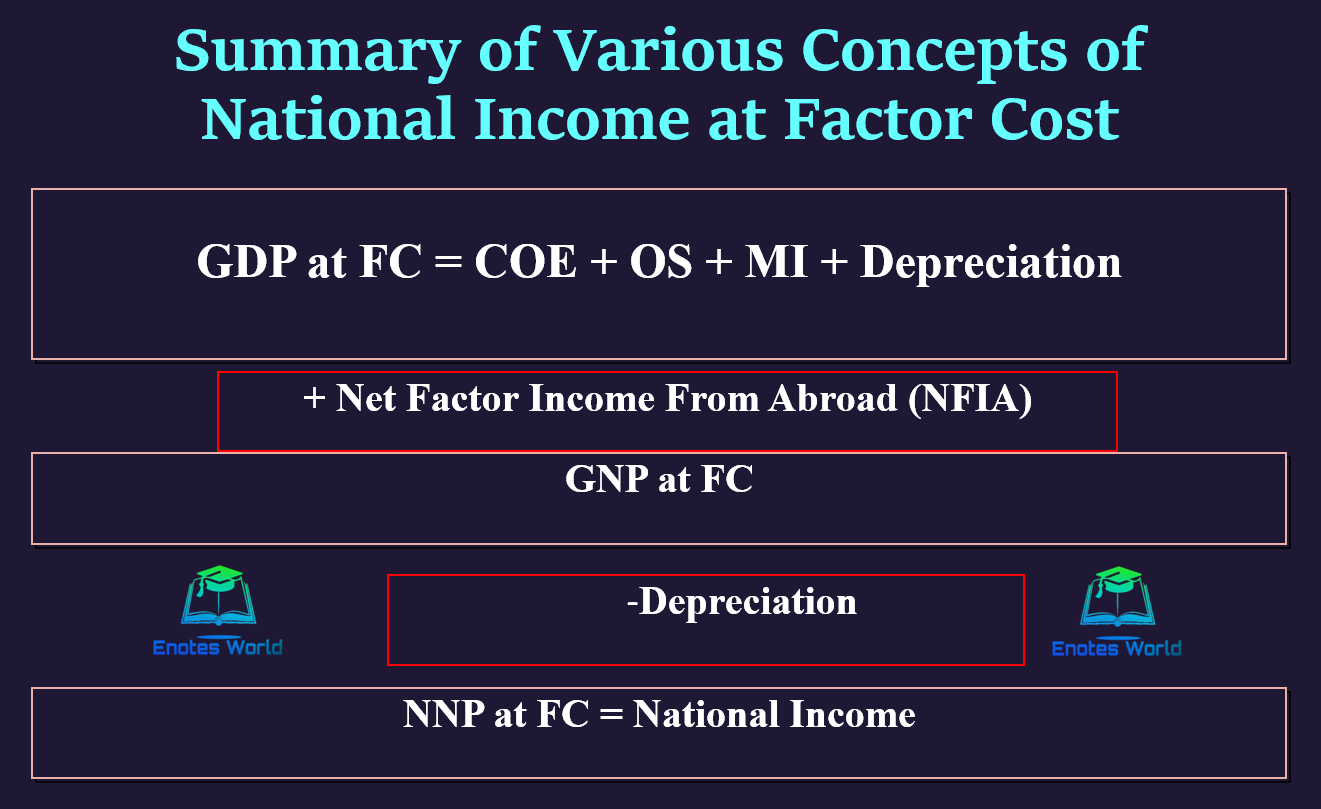

Summary

The key concepts of national income like GDP, NDP, GNP, and NNP are if measured in terms of price paid to the owners of factors of production then it is understood as an account of concepts of national income at factor costs. The following chart shows a summary of the measurement of different concepts of national income at factor costs.