Contents

Meaning of Equilibrium

The term equilibrium is defined as states in which at least two different opposite forces or powers are equal. Thus, equilibrium means a state of balance. Concerning the market, equilibrium is the position in which market demand for a commodity is exactly equal to the market supply of that commodity. This equality between two opposite market forces determines the equilibrium price in the market. Here the discussion includes the introduction to partial and general equilibrium.

The equilibrium price is defined as a price that makes market demand for a particular commodity equal to the market supply of that particular commodity. The market equilibrium generates three economic variables; equilibrium market demand, market supply, and equilibrium price.

Equilibrium is also called a market clearing situation and in such a particular situation there is neither overproduction/excess supply/surplus nor underproduction/shortage/excess demand. All the produced stock is sold and there will be no unsold stock in such a situation.

Market demand signifies the quantity demanded that individuals in the market are willing to buy at a given price. On the other hand market supply signifies the quantity that the seller of that particular commodity wishes to sell at a given price.

When the willingness to buy quantity becomes equal to the quantity that the seller wishes to sell at a particular price in the market, then it will generate market equilibrium. If this condition is not satisfied then the result will be either unsatisfying needs of buyers prevails in the market in case of greater demand than what is supplied and similarly, just it’s opposite when there is excess supply than the volume of quantity demanded.

Let’s take a mathematical look to understand the overall mechanism of a simple market equilibrium model.

Adding the demand of all the individuals for a particular commodity gives a market demand function for a good and shows the relationship between market price P and market demand Q. For a simple understanding let us take a linear demand function expressed as;

Market demand function Qd=a-bP

Where ‘a’, and ‘b’ are parameters (constant and positive). The negative sign carries by b shows the negative slope of the market demand curve or function. ‘Qd‘ is the market demand and it is assumed a dependent variable.

It makes sense because in the free market model we assume that price is given to all the consumers and consumers have to decide the volume of demand to be fulfilled at that particular given price.

Similarly, adding the supply of all the firms in the market gives a market supply function indicating a relationship between quantities offered by sellers Q at a given market price P. For simplicity let us consider the linear supply function expressed as;

Market supply function Qs=cP+d

Where ‘c’ and ‘d’ are parameters and ‘c’ must be positive indicates a slope of supply function or positive relation between price and quantity supply. The value of parameter ‘d’ could be probably zero or sometimes negative. ‘Qs’ is the quantity supplied and taken as a dependent variable.

It also makes sense because the producer’s price is given and they have to offer their production into the market as per their interest.

The equality of such market demand and supply function ensures the market is in a state of balance and which is known as market equilibrium. It means the quantity that consumers are willing to buy is equal to the quantity that sellers wish to offer and are equal to each other at a given price in the market. This can be expressed as;

Qd=Qs

This situation is called market equilibrium. If Qd is greater than Qs then it will create a shortage in the market and the price will be increased. Similarly, if Qs are greater than Qd it will create a surplus in the market and as a result, the price will be decreased. The case of shortage and surplus both show disequilibrium in the market.

Let us give values to our parameters in the model as;

Market demand function -4P +100, and

Market supply function 6P-20

For market equilibrium, the required condition is;

Qd=Qs

Here we have three simultaneous equations with three unknowns as Qd, Qs, and P. The equality between the demand function and supply function gives a solution for all the parameters. Thus,

-4P +100= 6P-20

The solution gives P= Rs. 12 per unit and is termed as equilibrium price. If we substitute the value of P in demand and supply functions we will obtain equilibrium quantity of demand and supply respectively as;

-4P +100= -4 *12+100= 52 units, and

6P-20 = 6*12-20= 52 units.

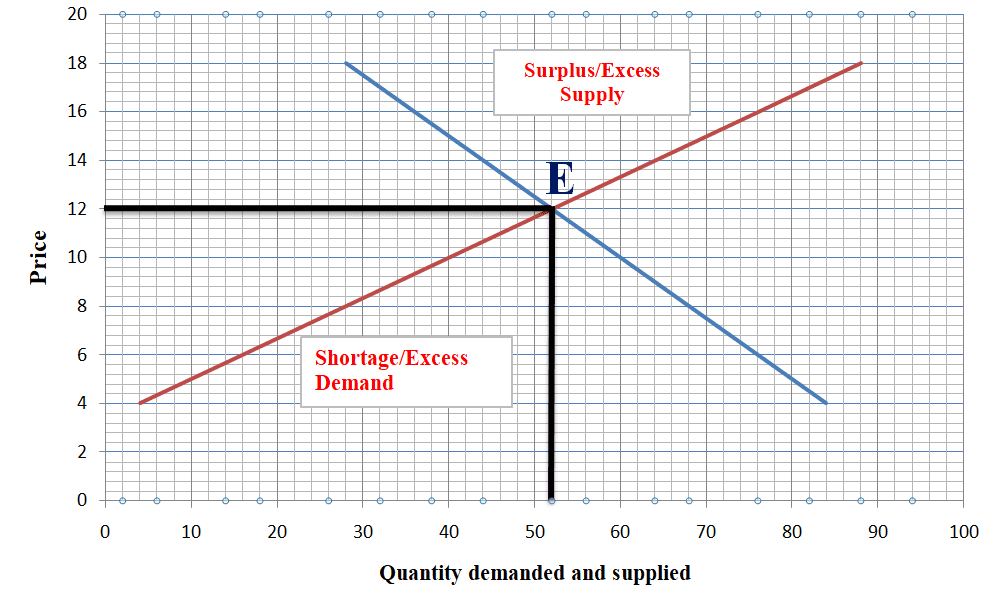

The graphic presentation of market equilibrium is given as;

In the graph ‘E’ point indicates market equilibrium and is the interaction of market demand and market supply. Corresponding price and quantities are measurement values of equilibrium price, the equilibrium quantity of demand, and supply respectively.

At that price the market is clear and there is neither an unsold stock nor unsatisfied demand. So any price beyond Rs. 12 creates a surplus or excess supply in the market and any price below Rs. 12 creates a shortage or excess demand in the market.

For example, let’s take the price to be Rs. 16 then what will happen to equilibrium values?

Market demand= -4P +100 = 36 units and Market supply= 6P-20 = 76 units

Here excess supply is seen due to the price having gone beyond the equilibrium level of price and surplus is by (76-36) 40 units.

It means there is unsold stock in the market and as the market is free so it ultimately creates competition between sellers to reduce the price and the price will sooner or later reach again Rs. 12.

Again, let’s take a price to be Rs. 8 then what will happen to equilibrium values?

Market demand= 68 units and market supply= 58 units.

Here it has resulted in excess demand or shortage in the market. It means there are unsatisfied or unfulfilled demands existing in the market and people will start to pay more or be willing to pay more for the product. This leads to competition among buyers and the price will tend to rise and sooner or later it again becomes Rs. 12.

Thus, Rs. 12 is the market-clearing price in the sense there is neither an unsold stock remaining with sellers nor unsatisfied demand with buyers. This state of balance is called market equilibrium and such mechanism of ensuring equilibrium is called free market mechanism and determination of equilibrium price and quantity.

Approaches to Equilibrium in Economics

In economics, the study of equilibrium can be done in two different approaches based on the considered subject of equilibrium. If we take a particular part of the economy considering no change in other parts or ignoring the change in other parts and their effects then it is called partial equilibrium analysis. On the other hand, if we consider all the markets of the entire economy in a framework then it is called general equilibrium analysis. Partial and general equilibrium has its own important contribution to economic analysis. The discussion on partial and general equilibrium can be presented below;

Partial Equilibrium

The partial approach is based on the analysis of a particular sector or part for instance equilibrium in the fruit market or a particular input market and so on of the economy in isolation. The concept of partial equilibrium is introduced by Alfred Marshall.

When we study the behavior of individual decision-making units and the working of individual markets for commodities and inputs under various market structures it is a case of partial equilibrium analysis.

It can be said that the partial equilibrium approach deals with each market independently without considering the effects of changes in other markets on the concerned market. The advantage of partial equilibrium is that it provides room for the analysts to focus on one thing at a time and thus avoid the puzzlement that can arise the entire economy is to be considered.

The partial equilibrium analysis does not observe how the various individual parts fit together to form an integrated economic system. This task is not here and is left to the duty of general equilibrium analysis.

Partial equilibrium studies in microeconomic analysis. In microeconomics, there is a study of the market for a particular commodity or a particular factor input. The price of a commodity is determined when the demand for that commodity is equal to its supply.

For example, the wage rate is determined when the demand for labor is equal to its supply. The interest rate is determined when the demand for savings is equal to its supply. In all these markets the equilibrium is attained at the point where the demand and supply are equal and no one has the inducement to disturb the position. This analysis is called partial equilibrium analysis. It focuses on the determination of equilibrium prices and quantities in a market ignoring the effect from other markets.

In analyzing the things going on in one market, things going on in other markets are completely ignored. So the chief attribute of a partial equilibrium approach is the determination of the price and quantity in a commodity market or a factor input market by demand and supply curves. We can say that the partial equilibrium is thus concerned with a restricted range of data.

Characteristics of the Partial Equilibrium Approach

The basic point of a partial equilibrium approach is the determination of the price and quantity in the product market or a factor input market by the interaction of demand and supply curves. The major characteristics of partial equilibrium are mentioned below;

It studies the behavior of economic participants

In partial equilibrium analysis, the behavior of individual decision-making units and individual markets is considered in separation. It examines how an individual maximizes his satisfaction subject to his income constraint. How a firm minimizes its cost of production, how a firm maximizes profits under various market conditions how the prices and employment of each type of input are determined.

No account of interconnections

The partial equilibrium analysis does not consider the interconnections that exist between an individual economic unit and the rest of the economy. These interconnections are left under the broad assumption of ceteris paribus. In other words, partial equilibrium analysis studies utility or profit-maximizing behavior and decisions in each sector of the economy separately. As if they were independent of the other segments of the economy.

For example, when we study the behavior of households in their role as consumers who allocate their income among various goods and services to maximize their utility subject to their income constraint partial equilibrium analysis easily assumes that the incomes are given. The income of the consumers depends upon the size of the factor services demanded and supplied in the factor market. Under the assumption of ceteris paribus partial equilibrium avoid this interconnection. Thus it makes it easy to isolate the study of consumer behavior from other parts of the economy.

Likewise if one has to study the cost-minimizing behavior of a business form he or she can limit himself or herself to the given prices of inputs and the known state of Technology. It is true due to partial equilibrium analysis.

Similarly when the study related to production decision is to bode then one can say that the production decision is taken in isolation and ignores the influence of affecting factors like the demand for the product and related goods. The demand for products is influenced by the employment, income, and taste of consumers.

Again if the study is needed relating to the profit-maximizing behavior of a business firm it can also be put in the limit to one product market and the study of each market based on the ceteris paribus assumptions.

Relationships with other markets are ignored.

Partial equilibrium analysis studies the behavior of individual economic segments in isolation and ignores their interdependence.

Use of Partial Equilibrium Analysis

The partial equilibrium is considered a useful model on the following grounds

The first one is when anyone is interested to know about the effect of change in policy or any factors in a particular market assuming that the market is an independent one then partial equilibrium allows him or her.

For example effect of a labor strike in the steel industry. Each market in partial equilibrium analysis is regarded as independent of the other.

The second is to assist the initial effects of government policies like excise or customs duty on some particular product. It is called an analysis of the impact effect.

Partial equilibrium analysis studies these initial effects or impact effects only. For example, the impact of a labor strike in the steel industry first is seen in steel production. This can be termed as first-order impact or impact effects. Later on, there will be spillover effects on the entire economy and this is termed the second and higher-order impacts. The higher-order impacts will be seen in the next instantaneous industry that usages still as input and ultimately in the entire economy.

The partial equilibrium analysis is concerned with measuring the first-order impact or impact effects only as opposed to general equilibrium analysis which attempts to measure the second and higher-order impacts of a change.

General Equilibrium Analysis

The general equilibrium analysis considers the fact of interdependence among different economic units. Interdependence in the economy makes partial equilibrium analysis very simple because demand and supply in one market depend on prices determining other markets. This concept was introduced by Leon Walras.

General equilibrium broadens the viewpoint of measuring equilibrium with consideration of interaction and interdependence within the various part of the economy and analyzes the determination of equilibrium in the same situation.

General equilibrium is an extensive study of several economic variables their interrelation and interdependence for analyzing the working of the economic system as a whole.

Everything depends on everything else is a fundamental characteristic of the modern economy. It means interdependence among its part parts is an essential feature of modern economies. This feature is recognized and applied by general equilibrium in its analysis. As a result, it is considered that the markets of the commodities and all predictive factors are interrelated and thus the prices in all markets are simultaneously determined.

For example, consumers’ demand for various goods and services depends on their tastes and incomes. Consumer incomes also depend on the demand and supply of the various inputs. The demand for factor inputs by firms depends not only on the state of technology but also on the demand for the final goods they produce. The demand for these goods depends on consumer incomes which depend on the demand for the factors of production. Thus the change in one market affects other markets which in turn affects the original market.

The disturbance in one market affects the entire economic system and the general equilibrium analysis concerns itself with the changes caused in the whole economy.

Here any change in one market affects other markets like the spillover effect and is affected by other markets called the feedback effects.

That interrelationship among markets is taken clearly into account in general equilibrium. It means general equilibrium explicitly considers the spillover effects, ripples effect, and feedback effects while determining the prices and quantities in all the markets simultaneously.

Use of General Equilibrium Analysis

General equilibrium analysis has two basic purposes

It ensures room for examining and analyzing the economic system as a whole.

It provides a logical and systematic approach to studying higher-order effects, ripples effect, and repercussion effects of an economic change.

General equilibrium is thus defined as a situation in which every market and every decision-making unit are simultaneously in equilibrium. Any economy is said to be in the state of general equilibrium if there prevails a set of prices that can link demand and supply and produce equilibria in every product and factor market that are mutually consistent.

Comparison between Partial and General Equilibrium

Partial equilibrium analysis studies the behavior of individual decision-making units and individual markets as independent units in isolation. Whereas general equilibrium exists when all markets in an economy are in simultaneous equilibrium.

The advantage of partial equilibrium is that it allows the analyst to focus on one thing at a time and eliminates the possible confusion that can arise if all the things are considered together. Whereas the advantage of general equilibrium analysis is that it analyzes the economic system as a whole.

The partial equilibrium analysis does not take into account the interconnections that exist between an individual economic unit and the rest of the economy. These interconnections are taken care of under the generic assumptions of other things remaining the same. Whereas general equilibrium analysis seeks to determine the equilibrium of an economy by analyzing the behavior of all interconnected and interdependent economic units and segments

In other words, in partial equilibrium analysis, we study utility or profit-maximizing behavior and decisions in each segment of the economy as if they were independent of the other segments of the economy. However general equilibrium analysis is concerned with the determination of equilibrium in all markets simultaneously.

Summary

Partial equilibrium analysis deals with the functioning of individual identities and individual markets independently. For example, producers maximize profit constraints to technology and resource. Similarly, consumers maximize utility constraints to the taste and budget. Likewise, changes in a single market are examined in isolation from other markets. Such an approach to economic analysis is referred to as partial equilibrium analysis. It is easy to conduct and understand.

General equilibrium holds while all markets in an economy are simultaneously in equilibrium. It looks for the determination of the equilibrium of an entire economy by analyzing the behavior of all interconnected and interdependent economic units and segments. Therefore general equilibrium analysis is concerned with the determination of equilibrium in all markets simultaneously. It is complex, time and cost-consuming. It measures the higher-order effects of a change in economic policy or economic variable over the entire economy. So partial and general equilibrium plays a vital role in economic analysis.