In modern times every economic analysis begins with models. So we need to know what the model is and how economists construct a model in economics to increase the understanding of real-world behaviors and economic problems.

Contents

Meaning of Model in Economics

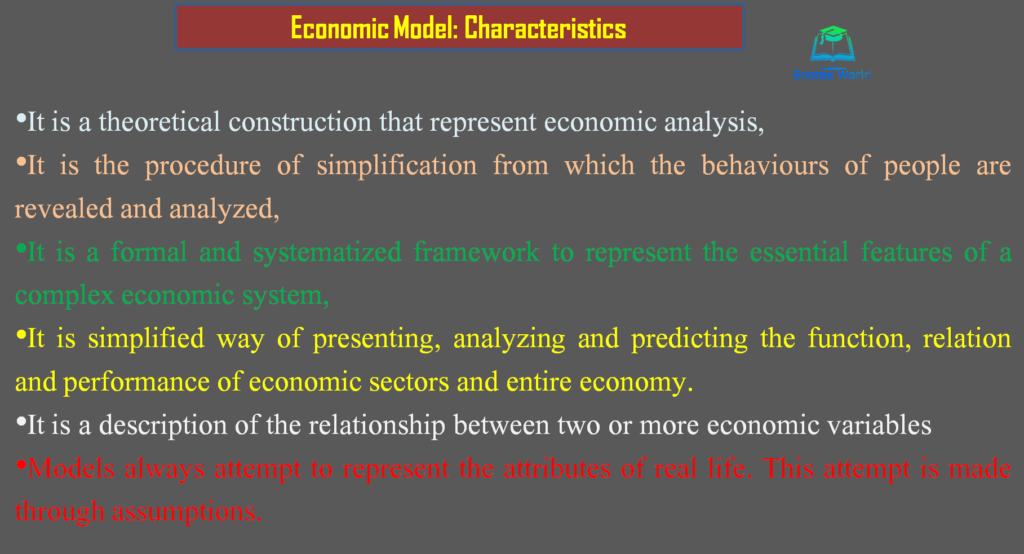

In simple words model in economics is simply a description of the economist’s view of how things work. It means economists develop and build models to explain the behavior of individual consumers, producers, industry, or the economy as a whole. Thus, the economic model or model in economics can be defined as an organized and systematic set of equations and functions that exhibit the relationships between different economic identity and their functions under a set of assumptions from which the conclusion or a set of conclusions is logically and rationally derived.

Every equation and function in the economic model attempts to explain the behavior of one variable which has been taken into consideration with another. Here economic identity can include a household, a single business firm, a region, or an entire economy of the whole world. The economic model is thus a deliberately simplified representation of the real world with the help of a set of logically arranged mathematical equations and functions.

There should be an interlinking relationship between variables considered in the model. The economic activities of different economic entities can be simply represented in terms of different economic variables. These variables are determined by the behavior of the individuals so they may be mutually associated with each other. The casual relationship between such variables always may not run in a single direction. One variable affects another and thereby other variables in the entire system.

For example, the level of income directly affects the amount of consumption and as a result, such will change the value of aggregate demand of the economy. Simultaneous measurement of values of different economic variables is thus essential in economic analysis. Models involving two or more functional relationships are needed to solve these issues in the analysis of economic variables.

Every scientific study and reasoning follows certain methods and procedures for the formulation of its laws, principles, and theorems. Economics as science also adopts certain methods and systematic procedures to discover and formulate economic laws, doctrines, and relationships. Thus, the model is needed to make this all simplified and well-framed for the illustration of complex economic associations.

Almost all models use mathematical techniques and methods to investigate theories in a more accurate manner. Models always attempt to represent the attributes of real life. This attempt is made through assumptions. However, assumptions may not exactly represent realism as they are reasonable abstractions from reality which means that certain aspects of reality are contained in the assumptions that are relevant to the model. Thus, the applicability of the findings of the model is based on the realism of assumptions set by such a model. A model thus may not describe the true economic world due to its nature. So the model is a simplification of reality.

An economic model or model in economics may be compared to a map that does not show every aspect of the topography but only those features that are of interest to the particular situation at hand. Like a map economic model pinpoints the particular situation and keeps it free from many complicating and irreverent factors found in the real world like the real territory on a map.

Purpose of Building Model

Economists build models for certain purposes. There are two purposes behind constructing a model in economics analysis or explanation and prediction.

Analysis

Analysis means the ability to explain the behavior of economic agents. In other words, analysis means breaking up a thing into the elements that go to make it. Economic models analyze a phenomenon in its various elements. Based on the assumption set in the model the facts are analyzed and deduced certain logic that explains the behavior of economic identity.

For example, in the theory of consumer behavior, the law of demand is deduced from a set of assumptions like unchanged tastes, prices of related goods, and the income of the consumer. Thus the assumptions of the law of demand together constitute the market behavior of consumers in this microeconomic model.

Prediction

Prediction refers to the ability of a model to predict future events and attributes. It means the ability to forecast the effects of changes in some magnitudes in the economy is reflected by the predictable ability of the model. For instance, a model may be constructed to explain the price of a particular product in the market for the next year based on the expected size of the production, the trend of price, the quantity of buffer stock, and prices in the past years.

The ability of prediction and extent and intensity of analysis of the model measure its goodness and validity. Such goodness can be measured based on its predictive power, consistency, and realism of its assumptions, its explanatory capacity, generality, and degree of simplicity.

The Validity of the Model

The usefulness and applicability of a particular economic and other model are based on its validity and adequacy. The validity or soundness of the model is a direct function of projection ability, the practicality of assumptions, and the degree of generality, steadiness, and effortlessness. Economists are not agreed upon a single criterion to compute and finalize a measuring standard for a sound model.

According to Friedman, the most important attribute of a valid and sound model is its predictive power which is to what extent the model can correctly predict the behavior of economic identity. As per him, the sound model should yield usable predictions and implications for real-world situations.

On the other hand, Paul Samuelsson considered the realism of assumptions and the analytical power of the model to describe the behavior of economic identities as essential characteristics of the sound model.

Thus a model should be built in such a way that it may be testable, and the validity of a model can be tested through the process of observation and verification. If the model can explain as well as predict accurately then only its validity will be proved. The higher the degree of consistency between the model and the real world greater will be the validity of the model.

So we can say that it may be a consensus among economists that the most important attributes of a valid model depend on its purpose. It means whether the model builder wants to use it for predicting the effect of a change in some variables or for analyzing and explaining the behavior of economic agents.

Regardless of the motive behind the model building the validity and soundness are measured by realistic assumptions, the generality of the model (wider applicability), and simple to understand. The simplicity of the model can be determined based on the realism of its assumptions, the number of equations, and functions that can be solved simultaneously.

Various Elements of the Model in Economics

Economic models express inter-relationships among different economic variables. In microeconomics, such variables are market demand, market supply, price of goods, price of inputs, and so on. In macroeconomics, national income, total consumption, total investment, general price level, economic growth, aggregate supply, and so on are considered important macroeconomic variables.

When an economist or a researcher identified a problem statement then he or she builds a model that describes the affair he or she wants to explain based on certain assumptions related to it. A mathematical model includes the basic three elements or components as the dependent variable, independent variables, and behavioral assumptions.

The major concepts or elements used in the construction of the model in economics can be explained below;

Variables

A Variable can be defined as something that takes different values over time under consideration. It can assume different specific values. Each variable is represented by a particular different symbol in the model. For example, demand may be represented by Qd and supply by Qs.

In a model, variables are presented as the dependent and independent variables.

Dependent variable

A dependent variable is that whose value or magnitude is related in some unique way to the change in the value of some other variables. The dependent variable is also known as the explained variable or regressed. For instance, being other things remain unchanged quantity demand is based on the price of the commodity. Here quantity demand is the dependent variable and the price of the commodity is the independent variable.

Independent variable

The Independent variable is who has a direct effect on the dependent variable. Independent variables are the source of effect on the dependent variables. The Independent variable is also called the explanatory variable or predictor or regressor. The predictor variable explains the variation in the response variable in the experimentation.

Similarly, a model may have endogenous and exogenous variables also. The variables

Endogenous variable

The variable whose values are required to be explained or predicted or generated by the model is called endogenous variables. The value of endogenous variables is derived from inside the model. These are the variables, which are determined within the system of equations. Demand, supply consumption, national income, interest rate, etc. are endogenous variables.

In the demand-supply model of pricing, prices are quantity are always interrelated. The value of one depends on the value of another variable. In solving, the demand and supply equations value of the price is obtained. By substituting the value of price in demand and supply equations quantity is determined. Here price and quantities are thus endogenous variables. The value of one depends on others and is determined within the system. The number of equations may be equal to the endogenous variables so these are also known as the controlled variable.

Exogenous variables

The variable whose values are not to be determined within the system but are assumed to be given or known in advance independently. It means the value of these variables is not determined by other variables within the model. They are not gathered or explained or predicted by the model means they are determined outside the model and system such as variables reflecting fiscal and monetary policy. Government spending, money supply, tax rates, time, weather conditions, exports, imports, profit, revenue, labor force, inventions, etc. are some examples of exogenous variables.

In the demand-supply model, the value of the quantity does not always depend on the price of the product but also depends on whether or the amount of rainfall in a place. Thus the supply function of agriculture output including rainfall can be expressed as;

Qs= a+ bP +cR

Where ‘a’ is the intercept parameter, R stands for the average rainfall in the place. Here Rainfall is an exogenous variable. Here a change in the price of output does not affect the rainfall. Thus any changes in the exogenous variables such as rainfall would cause a shift in the whole supply curve.

Stock variable

The stock variable is a quantity that can be measured at a specific point in time. For example, the supply of a commodity available in the market at a specific point in time is called a stock variable.

Flow variable

A flow variable is a quantity that can be measured in terms of a specific period. The market demand and supply schedules are flow variables. But a particular variable may be both a flow and a stock variable.

For example, supply in period t may be a function of the price in the succeeding period t+1, so that St=f (Pt+1). Here supply is a flow variable. On the other hand, demand may be a stock variable if it is a function of the price in the same period t so Dt= f (Pt).

Constant

It is something whose value remains unchanged. It is just the opposite of a variable. If the constant is attached to a variable then it is called the coefficient.

Parameters

A parameter is a symbol that is constant for any particular problem but may assume different values in different problems. Parameters are normally represented by such symbols as a,b, or.

Functional relationships

A functional relationship exists between two variables when a change in the value of one variable uniquely determines the changes in the value of other variables. It may contain two or more variables, the coefficient associated with them, and a constant term. In economic models, the functional relationship can be expressed as;

Qd=f (P) (Single independent variable)

Q=f (K.L) (Two independent variables)

Qd=f (P, Y, Pr. T) (Multivariable demand function)

Process of Building an Economic Model

The model building process includes the following steps;

Defining the problem

Defining the problem and identifying the model which is to be built is considered an initial step toward the model building. The identified problem may be related to any one of the economic identities. After identifying the problem and fixing the model to be constructed the contracture has to identify and develop the major variables relating to the identified problem.

Formulate assumptions

Setting assumptions related to the problem assigned in the model is the second step toward the model building. Based on assumptions different tentative relationships are established among the economic variables considered in the model.

Collection of data

The third stage is the collection of data and their classification to estimate the parameters of the model. Different statistical techniques are used to estimate the values of parameters.

Derive logical deductions

In the next steps the logical deduction through which the implications of assumptions are deduced and identified. These are considered the predictions about the model.

Empirical testing of model

Testing the predictions of the model against data on the actual behavior of the phenomenon being modeled is the next step in model building. This process requires observations and checking the consistency of predictions with real-life data.

Accepting, rejecting, or revising the model

After having the verification of predictions with real-life data if the predictions are found correct the model is considered scientifically valid and reliable. If it passes the test it is accepted and needs no further action. But if predictions are not supported by data, the model is in conflict with facts and is either rejected or amended.

Importance of Model in Economics

For every economic principle and doctrine to be understood in the proper way economic models are important and useful tools. They are the simplified construction of a complex economic system. The models are not accurate to reality but their simplified representation makes them great. The major uses or importance of the model in economics can be pointed out below;

- Good models always attempt to simplify reality. No model could be able to describe and represent the entire reality of the object or situation but they make simplified representations with the help of a set of assumptions relating to identified problems. Goodness is based on the realism of assumptions.

- Economic models guide certain issues or topics. The model guides the attention in a particular way and puts the focus on definite topics relating to a particular issue.

- Models in economics help to judge and verify different economic theories. It means different economic theories and variables under consideration can be verified with the help of econometric models.

- Economic models supply the numerical estimates of the coefficients of the economic relationships which may be then used for sound economic policies and prescriptions.

- They help in analyzing and forecasting future values of economic magnitudes with a certain degree of corresponding probability.

References

Ahuja, H.L. (2017). Advanced Economic Theory. New Delhi: S. Chand and Company.

Jhingan, M.L (2012). Advanced Economic Theory. New Delhi: Vrinda Publications (P) LTD.