Contents

Introduction

William J. Baumol confronted the assumption of profit maximization and argued that maximization of sales rather than profit is the ultimate objective of the firm. So, a firm should direct its energies on promoting and maximizing sales. He, therefore, called his hypothesis as Sales Revenue Maximization hypothesis. The sales maximization model is thus an alternative model for profit maximization. This alternative goal has assumed superior implications in the context of the growth of oligopolistic firms.

Baumol presented this hypothesis in 1958 through the article titled “Business Behaviour, Value, and Growth”. This objective of the corporation is regarded as more behavioral than operational. Here the term sales maximization refers to the maximization of total revenue from sales rather than maximizing physical units of sales. Baumol has not entirely ignored the profit motive of the firm. He is of the view that firms need minimum profit to spend on the expansion plans, make dividends to attract stock buyers in the future, spend to increase long-term sales and provide better returns to the shareholders. He writes- “My hypothesis is that oligopolists typically seek to maximize their sales subject to a minimum profit constraint”.

So, this model is from the perspective of managers rather than shareholders. Baumol also pointed out that entrepreneurs do not completely neglect costs and profit. The costs incurred should be covered and the usual rate of return on investment should be made (minimum rate of profit). Hence, so long as profit is at a satisfactory level, management tries to expansion of sales, and such sales revenue maximization is essential to maintain a competitive position in the market, maintaining the matter of interest of the managers as distinguished from shareholders and, increasing the prestige of the company.

The Ration of Model

Baumol argued that managers are interested more in sales maximization than profit. Since ownership and management in modern business are separate thus managers deviate from profit maximization and maximize their own utility. The reasons for the existence of such a mentality in top management are as follows;

- There is a more suitable relationship between salary and other facilities of the top management with sales revenue rather than profit.

- Banks and financial institutions like to make available finance to firms having increased sales.

- With higher sales revenue more salary and facilities can be provided to employees of all levels it is easier to solve personnel problems

- Higher sales enhance the prestige of the management, large profit goes to the pockets of shareholders.

- Managers want steady performance with satisfactory profit instead of unique profit maximization.

- The large and increased sales strengthen the power to adopt a competitive strategy.

- Managers prefer a stable performance with satisfactory profits to huge profit maximization projects. They realize an optimum profit in one period, they might find themselves in distress in other periods when profits are less than the maximum.

Assumptions of the Model

The sales revenue maximization model is based on the following assumptions;

- The time horizon of the firm is one period

- The single commodity is produced by the firm

- The time period is static

- The market is imperfectly competitive

- In this time period, the firm tries to maximize total sales revenue subject to profit constraints instead of a physical unit of output

- The firm should earn a minimum profit to keep shareholders happy and prevent a fall in the share price

- The traditional concept of cost and revenue is valid in which cost curves are U-shaped and demand curves.

Under the sales revenue maximization model/Baumol’s model the objective or goal of the firm is to maximize total revenue/output and the price is lower than under the objective of profit maximization. It means the main objective and constraint of the model are expressed as;

Objective: To maximize Output/Total Revenue (TR)=f(Q)

Constraint/Subject to Minimum Profit (Pmin)

Baumol has explained two types of equilibrium under sales revenue maximization as;

- Sales revenue maximization without profit constraint, and

- Sales revenue maximization with profit constraint.

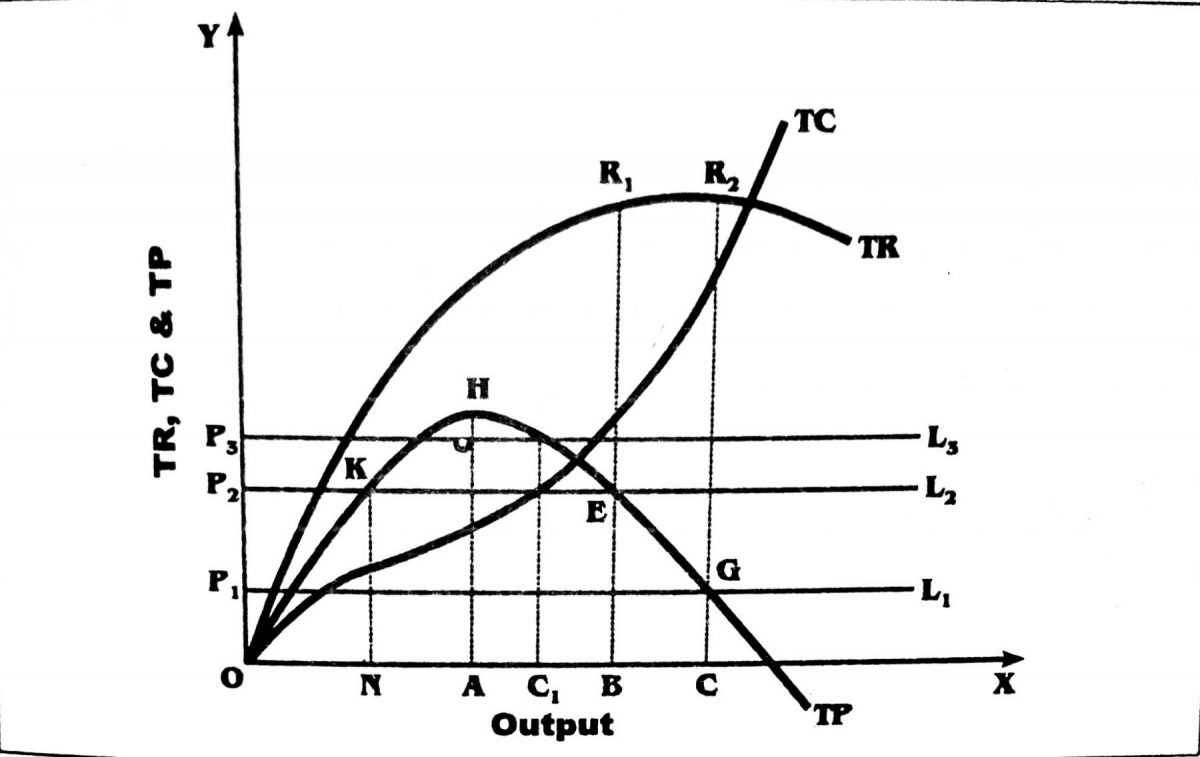

The concept of both types of equilibrium is explained with the help of the following diagram;

Sales Revenue Maximization Without Profit Constraint

In the case of no demand for profit by the shareholders of the firm, the manager independently sells the sales revenue maximization level of output. As shown in the above figure, the total profit curve TP measures the vertical distance between the total revenue and total cost at various levels of output. The total profit curve first rises and after a point falls downward. TR and TC curves are total revenue and total cost curves respectively.

If the firm aims at maximizing profit, it will produce the OA level of output as profit is maximum (AH) at this level of output. But according to Baumol, a firm does not seek maximum profit. Again, if the firm wants to maximize sales or total revenue it will fix output at OC, which is greater than ‘OA‘. At the output, ‘OC‘ total revenue is CR2 which is the maximum level of revenue. At this output, the firm is making a total profit equal to CG, which is less than the maximum attainable profit (maximum possible profit), AH. Thus, it is clear from the figure that sales or TR maximization output is OC and that is larger than profit-maximizing output OA.

Sales Revenue Maximization With Profit Constraint

Baumol did not entirely ignore the profit-earning goal of the corporation. He is pleased that the firm aims at sales revenue maximization subject to a profit constraint. In the above figure, P3L3 is the maximum profit line, P2L2 is the minimum profit constraint, and P1L1 is less than the expected level or less than the minimum profit constraint is also called non-operative profit. Here at the highest level of profit (P3L3) sales volume is minimum (OA), at minimum constraint profit (P2L2) sales volume is OB which is higher than OA, and at non-operative profit, sales volume is maximum as OC.

Thus, if OP1 is the minimum required profit, sales revenue-maximizing output will be OC and generate adequate profit and it is profitable for the firm to produce OC level of output. The sales revenue is determined by CR2. But if the required profit is OP2, then the OC level of output will generate an inadequate amount of profit, and the firm will produce at the OB level to get the minimum profit of OP2.

The firm in this case gets equilibrium only at output OB where the minimum required profit (profit constraint) is achieved. At this level of output (OB) the firm will have total revenue equal to R1B, which is less than the maximum possible total revenue of CR2. But the firm could earn the minimum required profit OP2 even by producing ON level of output but at ON level of output total revenue is less than that of OB.

Thus, under the sales maximization objective subject to profit constraint, there will be greater output and lower prices than profit maximization. Therefore, if the firms are guided by the sales revenue maximization objective there will be more possibility of an increase in the welfare of the people.

Critical Evaluation of Baumol’s Theory of Sales Revenue Maximization

Sales revenue maximization model advocates for lower prices and higher output than the profit maximization model. Total revenue is maximum at the price and output level where marginal revenue is zero. This theory is taken as an effective alternative to the profit maximization theory. It has focused its concentration on reality by reflecting on the business practices of the real world. However, it has the following shortcomings;

- In the long run, the motive of the theory is connected with the maximization of profit.

- This motive is fulfilled only by the ignorance of the demand for the product in the market.

- This theory does not explain the effect of new firms’ entry into the market

- It does not explain the interrelationship between firm and industry

- The sales revenue maximization hypothesis cannot be tested without the knowledge of the demand and cost functions of the firm. But the firm itself is unknown about the data and relevant pieces of information to demand and cost.

- This model is also unable to explain the problems of uncertainty under an oligopolistic market structure

- The sales revenue maximization model has not only ignored actual competition but also the threat of potential competition. This theory also fails to imagine that if a firm could take the share of a firm of the same or another industry its right on expanding sales is hampered by the reaction.