This part deals with some applications and extensions of basic demand and supply analysis. Such applications focus on the effect of various types of government interventions or policies on market equilibrium. Here we will discuss the Effect of government policies/intervention in market equilibrium. The tax, subsidies, and price control, etc. are the major governmental policies and that have a direct impact on market outcomes.

Contents

The Imposition of Tax and Impact in Market Equilibrium

Taxation is a major source of public revenue. In almost all the countries the largest part of the government revenue comes from taxes. The government may impose three types of taxes, namely a lump-sum tax (per period), profit tax, and specific sales tax.

Lump-sum Tax

The imposition of the lump-sum tax is independent of the prices of the product, level of output, and all the indigenous factors. So it is like a fixed cost to the business firm. It is a regressive type of tax and all have to pay the same amount regardless of circumstances. Thus lump-sum tax does not affect the marginal cost of the firm. It means, in the short-run lump-sum tax does not affect the MC curve and the firm will continue to produce the same output as before the imposition of the tax.

Profit Tax

The tax that takes the form of the percentage of net profit of the business firm is profit tax. This type of tax is also like a fixed cost and does not affect the MC of the firm. Like lump-sum tax, the profit tax has nothing to do with the marginal cost curve of the firm, and output decision is also not affected in the short run.

Specific Sales Tax/Specific Tax

Unlike lump-sum and profit tax, the specific tax has a direct effect on the marginal cost of the business firm. This tax takes the form of a given amount of tax per unit of output produced. So specific tax affects the marginal cost (MC) of the firm and as a result MC curve that is also the supply curve of the firm will shift upwards to the left and the amount to be produced will also be decreased. So specific tax is proportional to the level of output-higher the output higher will be taxation and vice versa.

Due to the imposition of a specific tax or per unit tax, the price of the product will increase and equilibrium output will decrease. The burden of specific or per unit tax or incidence of per unit specific tax is based on the elasticity of demand and supply. Here we will talk about the imposition of per unit tax on consumers, sellers, its incidences, and impact on market equilibrium one by one.

The Imposition of Specific per Unit Tax/Excise on Seller of a Product

An excise tax is a tax of a fixed amount on each unit of commodity. Per unit tax or excise taxes may impose on goods such as gasoline, liquor, and cigarettes. Here we discuss the effect of per-unit taxes on sellers affects the market outcomes.

When the specific tax is imposed on sellers of a particular product, the supply curve or marginal cost curve shifts to the upward direction to the left such that market equilibrium quantity is reduced and price for the consumers is increased. It is because the tax on sellers makes the business less profitable at any given price. The tax imposed on the seller increases the production cost and as a result, there is a decrease in the supply quantity at every price. On the other hand, the demand curve of the consumer will not be affected as the tax is not levied on buyers, so the quantity demand remains unaltered.

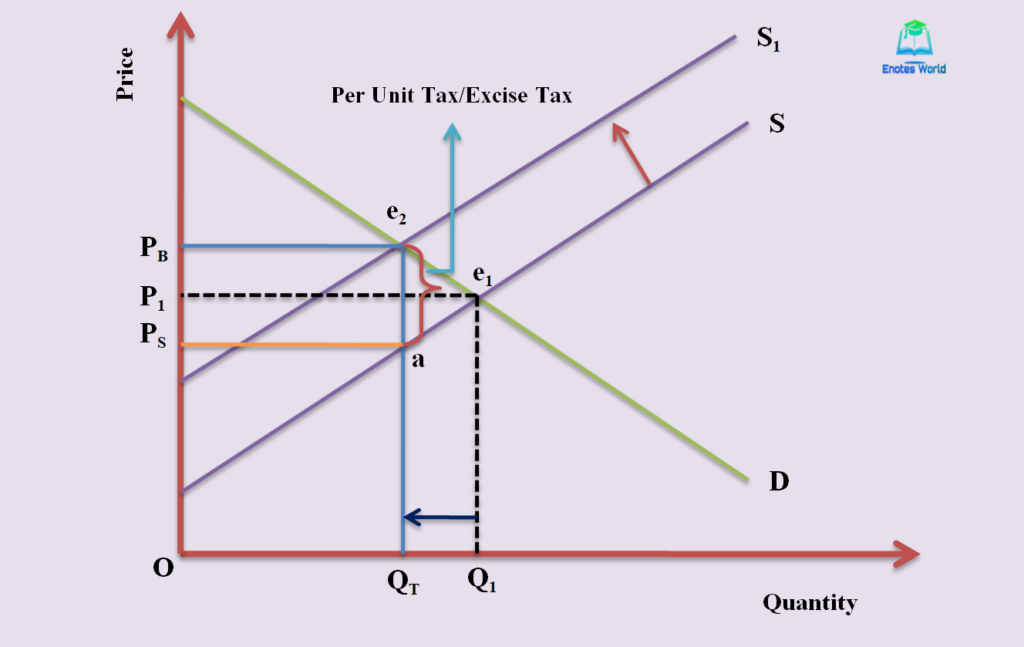

Knowing how the supply curve shifts and how the demand curve remains unchanged, now we can compute the initial and new equilibrium-equilibrium before the composition of tax and after the composition of tax. The following figure clearly shows this process.

In the figure, e1 is the initial equilibrium is the outcome of the interaction of demand and supply curve DD and SS respectively. At that point the equilibrium price is OP1 and the equilibrium quantity is OQ1. OP1 is the price paid by consumers and also the price received by the sellers. Suppose there is a per-unit tax or excise tax on the seller imposed by the government. Such taxation by the government will increase the cost of production and the supply curve. The supply or marginal cost curve of the seller shifts upward to the left as represented by S1S1. Here the demand curve does not change and as a result, a new equilibrium establishes by the interaction of DD and S1S1 at point e2.

At a new equilibrium position, the price payable by buyers is PB and the price that sellers finally receive is PS. The vertical distance between PB and PS is equal to e2a and that is per unit tax imposed by the government. Thus after the implosion of tax, the new equilibrium price becomes OPB but the price paid by consumers and received by sellers becomes different due to the imposition of taxation. Here consumers pay OPB price per unit, and sellers will receive OPS price per unit. Due to such the market also shifts from e1 to e2 with an increase in price and a decrease in equilibrium quantity.

Thus after the imposition of per unit tax on sellers,

- The price received by the sellers (PS) = New equilibrium price minus Tax (PB-e2a)

- The price paid by the buyers (PB) is the new equilibrium price.

- Even though the tax has imposed on the sellers but the burden is shared by both sellers and buyers. Here buyers have to bear the PBP1 amount of tax for every unit of purchase. Thus the tax makes buyers worse off. Sellers get a higher price from buyers (PB) than they got previously (P1), but the effective price after paying tax falls from P1 before the tax price to PS with the tax. Thus they bear the P1PS part of total tax and sellers also worse off.

- The new equilibrium price is PB which is higher than the equilibrium price before the imposition of tax and the new equilibrium quantity is Q2 which is less than the equilibrium quantity before charging tax. This shows the reduction of the size of the market due to the tax imposition.

- Taxes discourage market activity. When a good is taxed, the quantity that is sold at a new equilibrium will be a lower quantity than the quantity sold before the imposition of tax.

- Buyers and sellers share the burden of taxes. The incidence of such taxation is based on the nature of elasticity of demand and supply curves.

The Imposition of Specific per Unit Tax/Excise on Buyer of a Product

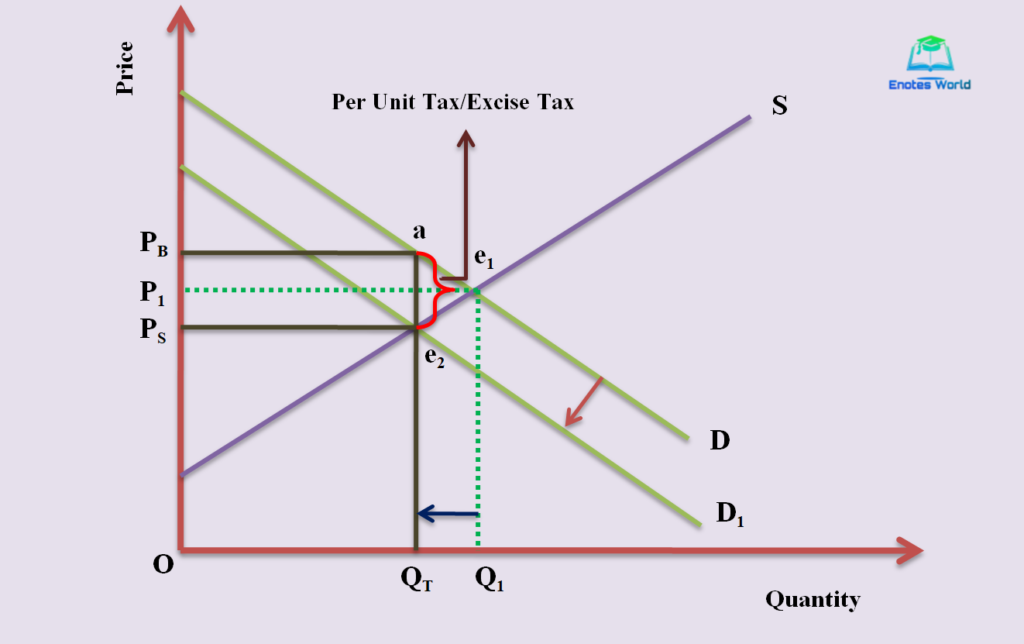

If the tax is levied on buyers of a good then its initial impact is on the demand for such a product. The supply curve is not affected because for any given price sellers have the same incentive to provide the product into the market. But consumers/buyers will have to pay tax to the government in the form of price to sellers at every buying by them.

Thus, the tax on buyers makes the product less attractive, they demand a smaller quantity at every price, and as a result demand curve shifts to the left or down to the left. With such a shift in the demand curve, the equilibrium quantity available in the market also reduces. The following figure shows the entire process of the effect of tax on market outcomes.

In the above figure, DD is demand before the imposition of tax by the government. Interacting with supply curve SS, e1 equilibrium has established with equilibrium price OP1 and equilibrium quantity OQ1. If the government imposes a tax on buyers, the tax shifts the demand curve downward from D to D1 by the exact size of the tax. Now the interaction of SS and D1D1 generates a new equilibrium e2.

At the new equilibrium position e2 the price that buyers pay is PB and that sellers receive is PS. The vertical gap between PB and PS is equal to e2a which is a tax per unit on the buyers. Before the tax imposition, the equilibrium price was P1 which implies that the price buyers pay and sellers receive are equal. But after-tax, the price buyers pay and what sellers receive are different. When the market shifts from e1 to e2, the quantity after-tax reduces from Q1 to Q2.

Thus after the imposition of per unit tax on buyers,

- The new equilibrium price is OPS and this is below the equilibrium price before tax (P1) and the equilibrium quantity is Q2 that is also below the equilibrium quantity before the imposition of tax (Q1). Thus tax shrinks the size of the market.

- The price buyers pay after-tax = new equilibrium price + tax per unit (here PS+PBPS). But the price seller receives is equal to the new equilibrium price that is below the equilibrium price before the imposition of tax.

- Even the tax has imposed on buyers but the burden is shared by sellers too. Buyers have to bear the P1PB part of the tax and sellers have to bear the P1PS part of the total per unit tax. Here new equilibrium price seems lower than the equilibrium price before tax so we can say buyers are paying the lower market price (lower equilibrium price) than before. But actually, they are paying more than that. Their effective price is the new equilibrium price plus per unit tax that is equal to PB in our diagram. So buyers are worse off due to tax. Similarly, sellers are also receiving a lower price than they received earlier. They are also worse off.

- Taxes discourage market activity. When a good is taxed, the quantity of the good traded in the market is smaller in the new equilibrium

- Buyers and sellers share the burden of taxes. The incidence of such taxation is based on the nature of elasticity of demand and supply curves.

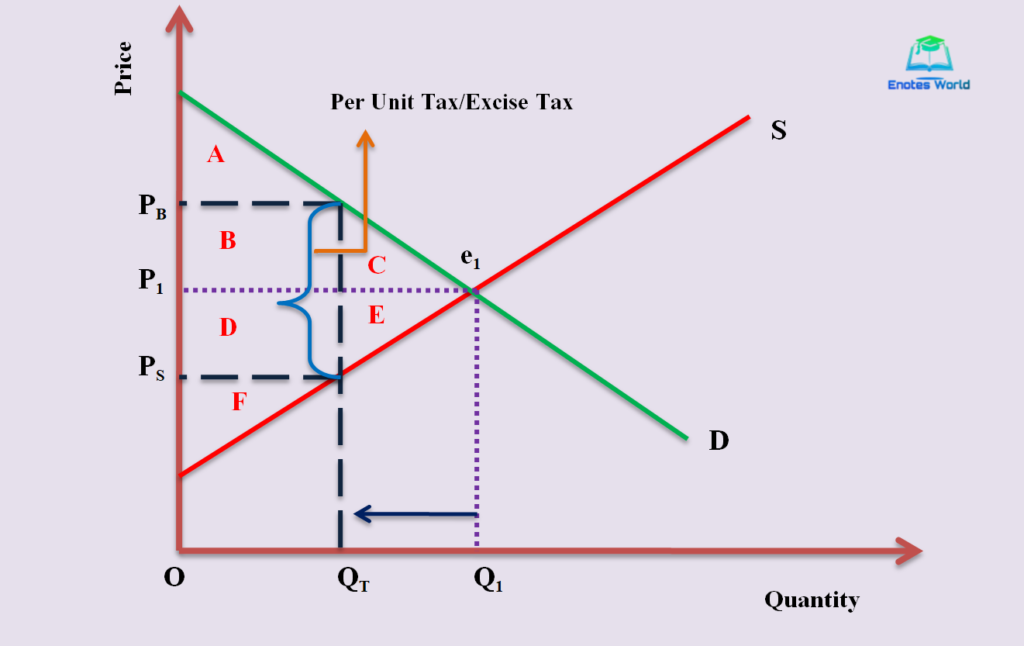

Implications OR Effect of Tax on Market Equilibrium Regardless of Subject of Tax

If we see the above two cases we will have a conclusion as taxes levied on sellers and taxes levied on buyers are equivalent. It means when the same amount of tax has imposed either on sellers or buyers the results are equivalent. In both cases, tax load splits between the price that consumers or buyers pay and the price that sellers or producers receive. Thus the burden of tax on the price of buyers of the price of sellers is the same not considering whether the tax is levied on buyers or sellers. In both cases, the wedge shifts the relative position of demand and supply curves. In the new equilibrium, both buyers and sellers share a load of tax imposed.

The single dissimilarity between tax on sellers and buyers is who sends the tax amount to the administration of government. When the government imposes a tax on sellers, the seller is required to place a certain per unit tax for every unit sold. Similarly when the government imposes a tax on buyers then buyers need to pose a certain per unit tax in every unit of purchase. Once the market attaints equilibrium after imposition of tax by the government then both sellers and buyers share the burden of it not depending on how the tax is imposed or who has been taxed. It shrinks the size of the market, creates deadweight loss, and worse off consumers as well as sellers. The following diagram shows the effect of the imposition of tax regardless of who has taxed and resulting deadweight loss from the tax.

Suppose the government has imposed a specific tax (either on the seller or consumer it doesn’t matter) equals to PBPS. Now the overall effect can be presented below.

| Title | Before Tax Value | After-Tax Value |

| Tax | – | PBPS |

| Equilibrium Price | OP1 | – |

| Price Paid by Buyers | OP1 | OPB |

| Price Received by Sellers | OP1 | OPS |

| Equilibrium Quantity | OQ1 | OQT |

| Consumer Surplus | A+B+C | A (Loss by B+C) |

| Producers Surplus | D+E+F | F (Loss by D+E) |

| Tax Revenue | – | B+D |

| Total Surplus | A+B+C+D+E+F | A+F+B+D |

*Total Surplus Before Tax=Consumer Surplus + Producer Surplus

*Total Surplus After Tax=Consumer Surplus + Producer Surplus + Tax Revenue

Comparing the obtained information and values we gen following conclusions;

- Total surplus before tax is higher than that of after-tax,

- Deadweight loss=Lost surplus from the part of consumers as well as producers and it is C+D

- Therefore imposition of tax in the perfectly competitive free market results in the creation of deadweight loss and shrink in the market.

Conclusion

The article has discussed the Effect of Government Policies/Intervention in Market Equilibrium. The government policies may include taxes and subsidies. Here we only talked about the effect of tax on market outcomes. The tax can impose on both buyers as well as sellers both. When the tax is levied on buyers then it causes the demand curve to shift downwards by the exact amount of tax.

On the other hand, if the tax is levied on sellers then it causes the supply curve to shift upwards by the exact amount of tax imposed. It does not matter whom the tax is imposed, the imposition of the tax causes the price paid by the buyers to increase, and the price received by the sellers to decrease. It also results in output shrink and sub-optimal market outcomes. Thus tax imposition will worse off buyers as well as sellers and we can say that there is a direct effect of government policies/intervention in market equilibrium.

References and Suggested Readings

Dhakal, R. (2019). Microeconomics for Business. Kathmandu: Samjhana Publication Pvt. Ltd.

Dwibedi, D.N. (2003). Microeconomics Theory and Applications. Delhi: Vikas Publishing House Pvt. Ltd.

Koutsoyiannis, A. (1979). Modern Microeconomics. London: ELBS/Macmillan.

Mankiw, N.G. (2009). Principles of Microeconomics. New Delhi: Centage Learning India Private Limited

Shrestha, P.P. and et.al. (2019). Microeconomics for Business. Kathmandu: Advance Sarswati Prakashan.