| Learning Objectives |

| To discuss how the price elasticities of demand and supply measure the load of taxation on buyers/consumers and sellers |

When the government imposes a tax, buyers, as well as sellers of the product, bear the burden of taxation. But without knowing the degree of elasticity we cannot say who bears how much load of tax. Only rarely will it be shared equally. Thus the elasticity of demand and supply determines the burden of the tax. Here we will know about the elasticity of demand and supply and tax Incidence on buyers and sellers. The following cases with different degrees of elasticity will help to see how a load of taxation or the incidence of tax can share between sellers and buyers.

Contents

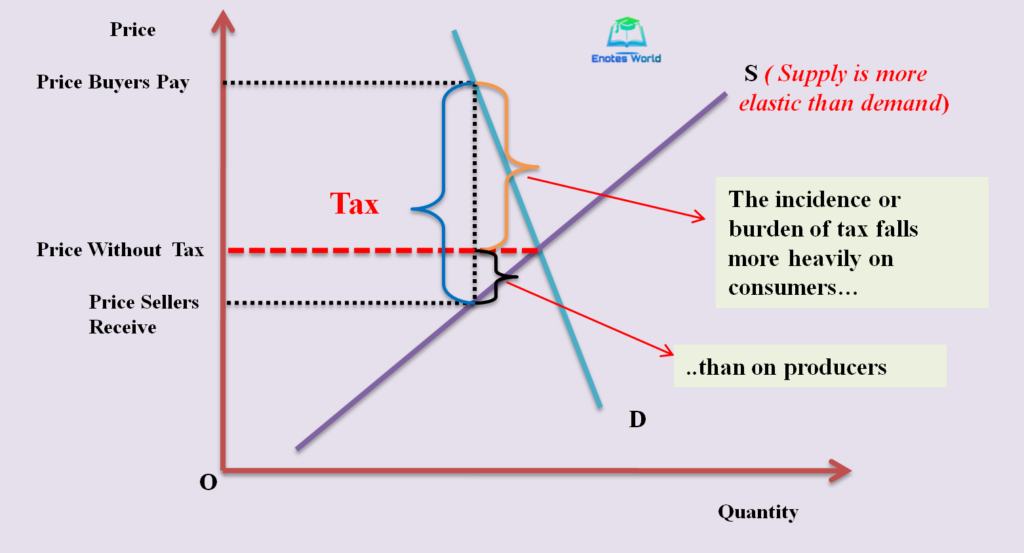

Case-I: Elastic Supply and Inelastic Demand

The following figure shows the initial demand curve and supply curve and a tax that drives the load between the amount paid by buyers and the amount received by sellers. The new demand/supply curve is not drawn as which curve will be shifted depends on who is to be taxed and as we already know the effect of taxing either consumers or sellers will have an equivalent effect.

This is the case of having an elastic supply and relatively inelastic demand. Here elastic supply refers to the highly responsive behavior of the sellers towards change in prices. So the supply curve is flatter. Buyers are relatively inelastic means they are not very responsive towards change in prices. So the demand curve is relatively steeper. When the government imposes a tax on a market having such elasticities, the price received by sellers does not fall much, so sellers bear only a small load of taxation. It means the price paid by the consumers rises substantially and they bear most of the load of the taxation. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. The above figure has clearly shown the given case.

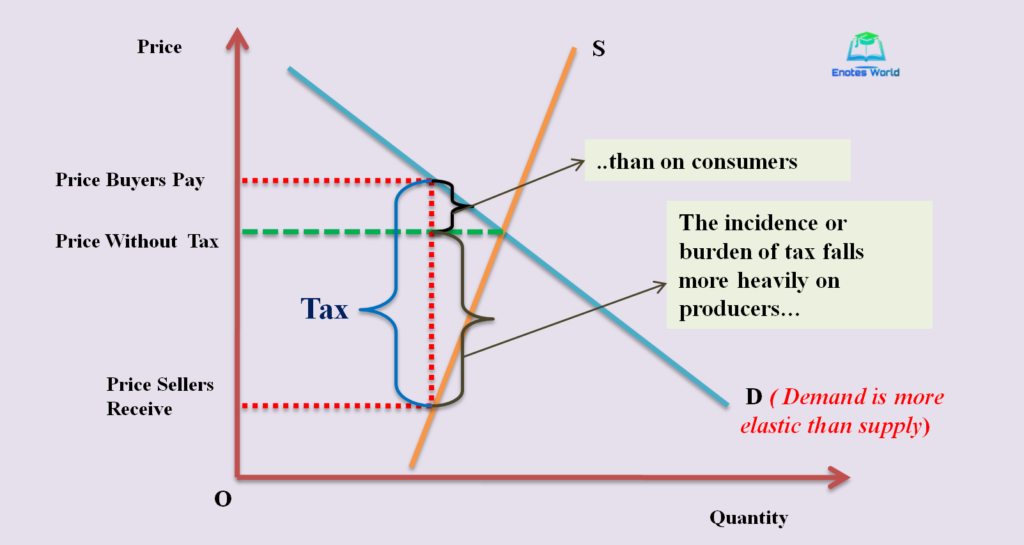

Case-II: Elastic Demand and Inelastic Supply

In this case, the supply curve is relatively inelastic and the demand curve is highly elastic. Relatively inelastic supply means suppliers are not much responsive towards change in prices. The inelastic supply curve has represented by the steeper supply curve. Similarly, an elastic demand curve deals with the highly sensitive behavior of buyers towards change in prices. That is why the demand curve is flatter. The following figure explains this case more clearly.

When the government imposes a tax in the market having such condition, the price that buyers will have to pay will not increase so much. On the other hand, the price that sellers will receive will fall substantially. This means the sellers will have to bear a larger load of taxation.

The Formula for Measuring Tax Incidence

The following formula has been used to measure the incidence of tax on buyers and sellers.

dTB=(es/es-ed)*dT

Where, dtB =Buyer’s Share in Tax; es= Elasticity of Supply; ed= Elasticity of Demand; dT= Change in Amount of Tax

For instance, let us assume the elasticity of demand for a product or elasticity for consumers is -0.6, and elasticity of supply or elasticity for suppliers is 0.4 and the government imposes a tax of Rs. 100 per unit of product. Assuming this tax is a new tax, thus dT= T.

A load of tax on that particular product on buyers can be measured as;

TB= {0.4/0.4-(-0.6)}*100= (0.4/1)*100= Rs. 40

This implies that the product buyers bear only Rs. 40 of a specific tax of Rs. 100 per unit and the rest will bear by the sellers of that product. Here buyers bear a lower amount of tax load as demand elasticity is higher (-0.6) than that of sellers.

If we reverse the coefficients of elasticity as ed=-0.4 and es=0.6 then the calculation will go as below;

TB= {0.6/0.6-(-0.4)}*100= (0.6/1)*100= Rs. 60

Thus, from the above calculation also we can conclude that the lower the elasticity, the higher the burden of tax and vice-versa.

Conclusion

The above two cases show the division of burden or load of taxation. The general conclusions drawn from the discussion are that a load of tax remains more on the market when supply is less elastic and it means demand is highly elastic. A load of taxation remains more on the part of consumers if they are relatively inelastic and the market is highly elastic.

References and Suggested Readings

Dwibedi, D.N. (2003). Microeconomics Theory and Applications. Delhi: Vikas Publishing House Pvt. Ltd.

Koutsoyiannis, A. (1979). Modern Microeconomics. London: ELBS/Macmillan.

Mankiw, N.G. (2009). Principles of Microeconomics. New Delhi: Centage Learning India Private Limited