Here in this article, we have tried to define personal income, disposable income, per capita income, and personal income.

Contents

Personal Income (PI)

Personal income can be defined as the income obtained by all individuals and households of a nation from all the possible formal sources before payment of direct personal tax or income tax during a certain fixed time. Major attributes of personal income are listed below.

- It is the sum of all kinds of income received by individuals from all possible sources of income.

- Personal income is income before direct tax.

- It includes compensation of employees, part of an operating surplus (except retained earnings and corporate income tax), income from self-employment, mixed-income, transfer payments, etc.

- By definition, personal income may include illegal incomes but in economic analysis, income earned from illegal sources are not recorded in national income.

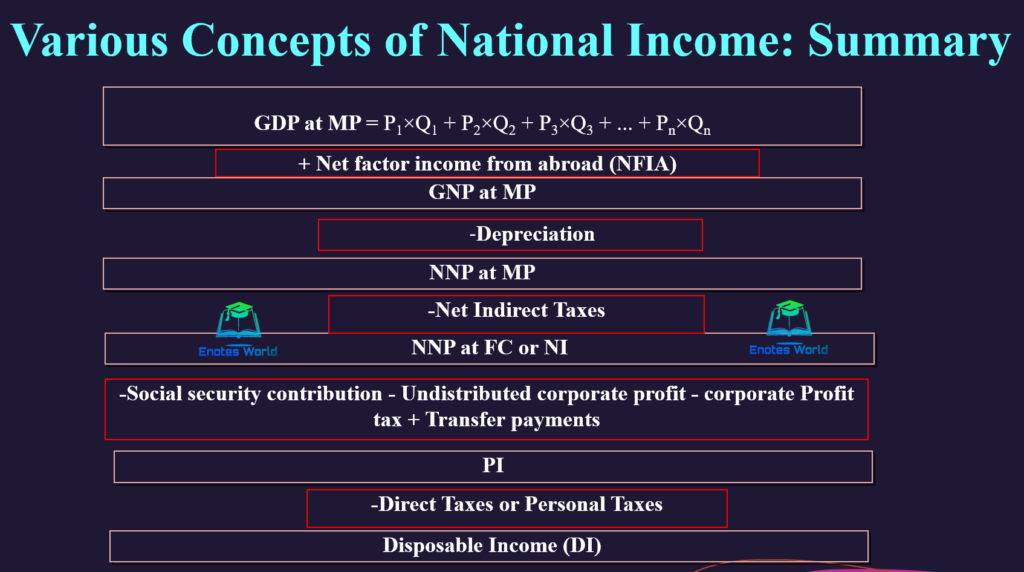

- To compute personal income from national income, undistributed profit or retained earnings, corporate income tax, and social security contribution are reduced, and transfer payments are added.

So, Personal Income (PI) = NNP at FC – Undistributed Profit/Retained Earning-Corporate Income Tax – Social Security Contribution + Transfer Payments

Symbolically,

PI = NI – UDP-CIT – SSC + TP

Where PI is personal income, NI is national income, UDP is undistributed profit, CIT is corporate income tax, SSC is social security contribution and TP is transfer payments.

Here corporate income tax or corporate tax or corporate profit tax should be paid to the government from corporate profit and which is not accessible to the shareholders. Accordingly, some portion of corporate profit is not distributed to the shareholders that are called the undistributed profit. Similarly, social security contributions such as provident funds, pension funds, etc. are reduced from the wages and salaries. So, they should subtract from the net national product at factor cost to measure personal income. On the other side, transfer payments in the form of unemployment benefits, old-age pension, etc. are added to NI to measure personal income as such items are not included in the measurement of national income. Here transfer payments may include current transfers from the government, from the business sector, and from the rest of the world sector.

Disposable Income (DI)

Disposable Income can be defined as the part of personal income that is available for disposal or for expenses. After deduction of income tax or personal income tax from personal income, disposable income can be obtained. Disposable income represents the purchasing power of income earners or households. The following expression shows the formula to measure the value of disposable income.

Disposable Income (DI) = Personal Income (PI) – Personal Direct Tax

After payment of tax to the tax authority, the residual part of personal income (disposable income) is either consumed or saved or partially consumed and saved. Thus, disposable income can also be expressed as

Disposable Income (DI) = Consumption (C) + Saving (S)

Therefore, disposable income is that part of personal income after deduction of direct tax.

Per Capita Income (PCI)

Per capita income is the average income of the people of the nation for a specified time. It is national income divided by the total population of a country for the respective year. Thus, per capita income is computed as

Per Capita Income (PCI) = National Income for Year t/Total Population of Year t

As the value of per capita income shows the average income of people living in a nation, it represents the living standard of people. However, the measurement of living standards of people based on per capita income is not so reliable as it is not able to trace out the unequal distribution of income and wealth between people of the nation.

Personal Saving (PS)

It can be defined as the part of disposable income left after consumption. So, if private consumption expenditure is deducted from disposable income, then the remaining amount of disposable income is left for saving. It is a surplus amount of disposable income over consumption expenditure.

Personal Saving (PS) = Disposable Income – Private Consumption

Summary of different concepts of national income along with personal income disposable income per capita income and personal saving.