Nowadays it becomes a regular phenomenon to see the dynamics of almost all the economic analyses and economic relationships. Before the 1920s dynamic analysis was confined only to certain analyses like an explanation of the business cycle. Since 1925, dynamic analysis has been used extensively in almost all branches of economics including the explanation of business fluctuations, income determination, and growth and price theories.

Economists like R. Frisch, C.F. Roos, J. Tinbergen, M. Kalecki, Paul Samuelsson, and many others have formulated dynamic models.

English economists like Robertson, Keynes, Kahn and Swedish economists like Ohlin, Lindahl, and Lundberg have contributed to economic dynamics in income analysis.

Recent economists Samuelson, Goodwin, Smithies, Domar, Hicks, and Koopmans, etc. have further extended and developed dynamic models relating to stability and fluctuations around the equilibrium path and they have also extended the concept in the areas of cycles, income determination, economic growth, price theory, etc.

Before discussing three categories of economic analysis let us discuss the term equilibrium.

The term equilibrium is defined in economics as a position from which there is no reason to move. When there is no propensity to change the position because the interacting opposite forces are equating to each other. Positions of equilibrium are very rarely attained, but they are considered important because they indicate the direction in which economic variables will tend to move if they are not in equilibrium.

The analysis of economic equilibrium can be categorized into three types;

Contents

Static Equilibrium- Economic Statics

The term statics originated from the Greek word statike which means bringing to a standstill. In physics, it means a state of rest and there is no movement. In economics, statics means it refers to a situation characterized by movement at a particular level without any change. An economic variable is said to be static if the value of the variable does not change over time. It means the value is constant over time. For example, if the price of the product does not change with passes of time then the price is called a static price or stationary variable.

It is needed to know that a variable may be changing from the micro point of view but static from the macro point of view. For example, the price of the individual product may be changing but the general price level may remain unchanged (static) over time. Similarly, the national income of the nation may remain stationary over time but its composition may change.

Economic statics refers to the functional relationship between two variables whose value relates to the same point of time or the same period. So it is a static/stationary relationship between interconnected economic variables. The entire relevant variable should relate to the same point of time or the same period.

In economics the quantity demanded of a good at a particular point in time is generally related to the price of that good at the same point in time. So the theory of product pricing, the theory of demand, the theory of supply, etc. is an examples of economic statics. Static economic analysis is thus timeless analysis were no changes occur and thus equilibrium has existed without any tendency of either variable to deviate from the system.

Static analysis can be further seen as micro statics and macro statics.

Micro-statics

If the static equilibrium includes microeconomic variables then it is micro-statics equilibrium. The functional relationship between microeconomic variables under the equilibrium condition at a particular point of time is known as micro-statics. It advocates for the unchanged or stationary relationship of microeconomic variables.

It assumes that there is no fluctuation or disturbances in the equilibrium of microeconomic variables. Market demand and supply, marginal revenue, and marginal cost relationship at a particular point in time are examples of micro-statics. The micro-static equilibrium is explained with the help of the following system;

The given demand and supply functions are

D=f (P)…… (1)

S=f (P)…….. (2)

At equilibrium, Demand = Supply or, D=S….. (3)

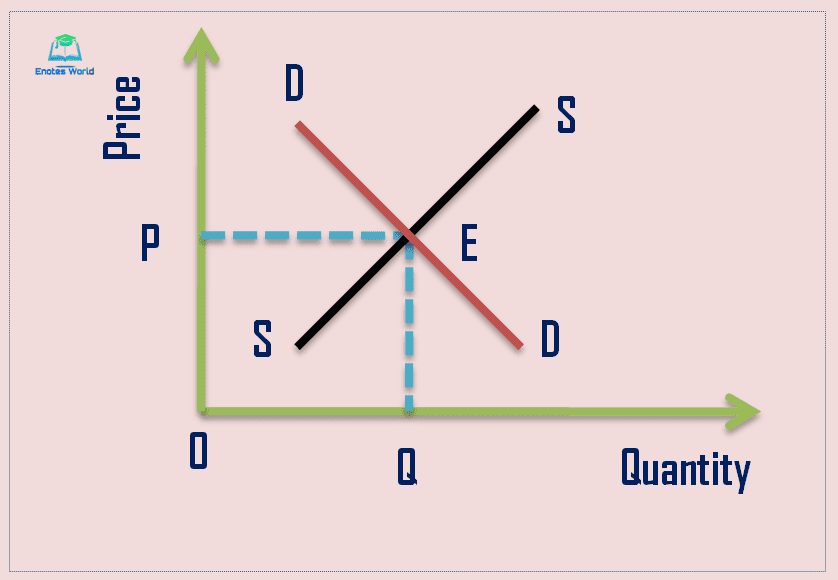

Where D is the quantity demanded of any particular commodity, S is the quantity supplied of that commodity and P is the price. These all variables are considered as relating to a particular point of time in micro statics. The point where both of them are intersected is called static equilibrium. It can be shown as;

In the above diagram E is the intersection point of demand and supply where the OP price and the OQ quantity of demand and supply are determined. If we do not allow any changes in demand and supply over time then it is considered a static equilibrium. Such timeless analysis is called static analysis.

Macro-statics

Macro-statics is a timeless system of analysis used to explain the certain aggregate relationship of an economy. It shows the relationship between different macroeconomic variables at a particular point in time under the state of equilibrium. It shows the still picture of the economy as a whole.

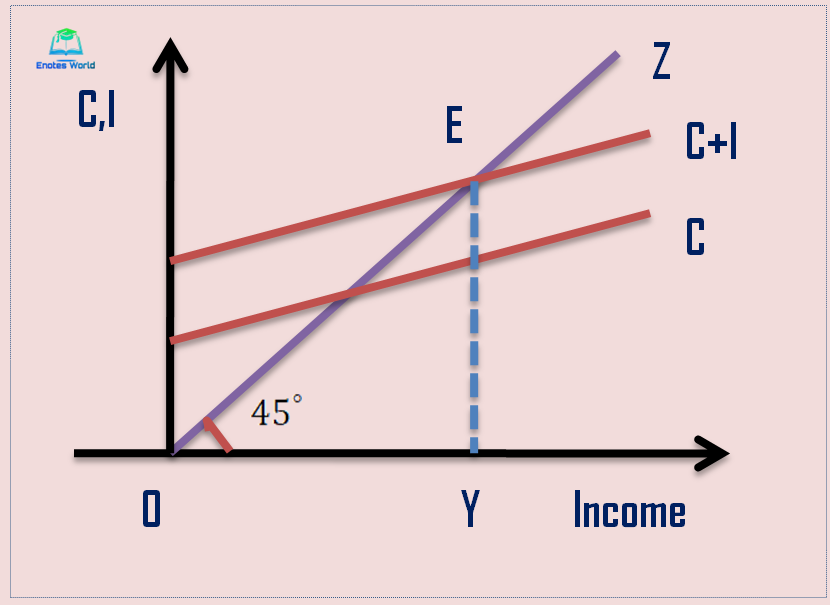

So it is the functional relationship between macro-economic variables in the final position of equilibrium regardless of the process of adjustment needed to reach the final position. This final equilibrium can be presented with the help of the Keynesian model of income determination expressed as below;

Y=C+I

Where Y is total income, C is total consumption expenditure and I denote total investment expenditure. It simply shows a timeless identity equation without any time adjustment. It can be shown in the following diagram;

In the static Keynesian model, the national income is determined by the interaction of the aggregate demand function and aggregate supply function related to a particular point in time. The 450 line represents the aggregate supply line and the C+I line represents the aggregate demand line. E is the static-macroeconomic equilibrium point with the OY level of national income.

Therefore economic statics refers to the timeless economy without considering the adjustment process to reach the final position of equilibrium. It is just like a snapshot photo from a camera that would be the same whether or not the subsequent position of the economy or variables of the model change.

Assumptions of Economic Statics

The analysis of economic statics/Economic Statics in Economics is based on the following assumptions

- There is no change in factors or variables that affect the selected interconnected variables in the model. For example, in the analysis of price determination under the perfect competition market, the factors affecting market demand are assumed to be constant. Similarly, the price of productive factors remains constant to assume a stable supply.

- The given data and variables are assumed to be independent of the behavior of variables in the given system in which the functional relationship is determined.

- Variables are studied at a particular point in time. It means variables and their relations over time is not included in static analysis.

- There is a one-way relationship between the behavior of economic variables and data in the model.

Importance of Economic Statics

Static analysis/Economic Statics in Economics is important for the following reasons

- Economic statics gives a foundation to economic dynamics. It includes introductory pedagogic value. Assuming a certain set of variables given and constant makes economic problems easy to comprehend.

- Economic statics provides an imaginary model of economic variables in the state of rest which helps the learners to understand the consequences of certain changes. For example, in the static market equilibrium model, market demand, market supply, and price are always constant. One can see the effect of variation in demand, supply, price, and their effect on the model, for such first static equilibrium is to be understood or needed to do such.

- The traditional economists assumed and applied static concepts to analyze and investigate. They study the activities of firms, industries, and consumers for the understanding of social linkages. That study stimulated to go for further development and dynamic analysis is the outcome.

- To study the comparative relationship between the same variables at two different times the static analysis is essential.

- The economic static is a simplified model or technique of analysis relating to the complex behavior of economic agents. It makes an easy to understand and study the complex economic behavior of individuals, societies, and markets.

According to Robert Dorfman, “statics is much more important than dynamics, partly because it is the ultimate destination that counts in most human affairs, and partly because the ultimate equilibrium strongly influences the time paths that are taken to reach it, whereas the reverse influences are much weaker.”

Limitations

Following are the major limitations of static analysis/Economic Statics in Economics.

- It is far from reality as it assumes changing variables like population, tastes, techniques, etc. as given and constant. It also excludes the influences of external forces and is thus related to a closed economy. All this makes it an unrealistic analysis.

- It neglects the influence of the time factor. It applies to timeless mechanisms only. So it is only the fantasy of imagination and an intellectual toy with which economists play.

Conclusion

Static analysis is the foundation for dynamic analysis. The static analysis ignores the passes of time and seeks to establish the causal relationship between certain variables relating to the same point of time, assuming some determining factors remain constant.

References

Ahuja, H.L. (2017). Advanced Economic Theory. New Delhi: S. Chand and Company.

Jhingan, M.L (2012). Advanced Economic Theory. New Delhi: Vrinda Publications (P) LTD.

Maddala, G.S., & Miller, Ellen. (2004). Microeconomics Theory and Applications. Chennai: McGraw Hill Education (India) Private Limited.