Contents

Meaning of Subsidy

A subsidy may be defined as the financial help granted to the producers or the consumers of subsidized commodities. Similarly, a subsidy may be in the form of a production subsidy and user subsidy. The subsidy is the opposite of the tax. It is also one of the significant policies of the government to influence the market. Under the production subsidy scheme, the producers pay a lower price than the market price as they are encouraged by the government to supply more. It includes government assistance in the creation of new firms, industry, in the prices of inputs supplied, for example, electricity, transportation, and materials, etc.

Similarly, under the consumer or buyer subsidy the consumers charge a lower price than the market price. When the government provides a subsidy to sellers or buyers of a particular product, the new equilibrium quantity is increased with buyers paying less and sellers receiving more than the pre-subsidy situation. Here we will discuss the effect of the provision of subsidy on producers and buyers on the market outcomes (Effect of Subsidy in Market Equilibrium). First, we see the effect of subsidy to sellees/producers, then subsidy to consumers and its effect on market equilibrium.

Case-I: Provision of Subsidy to Sellers of a Product

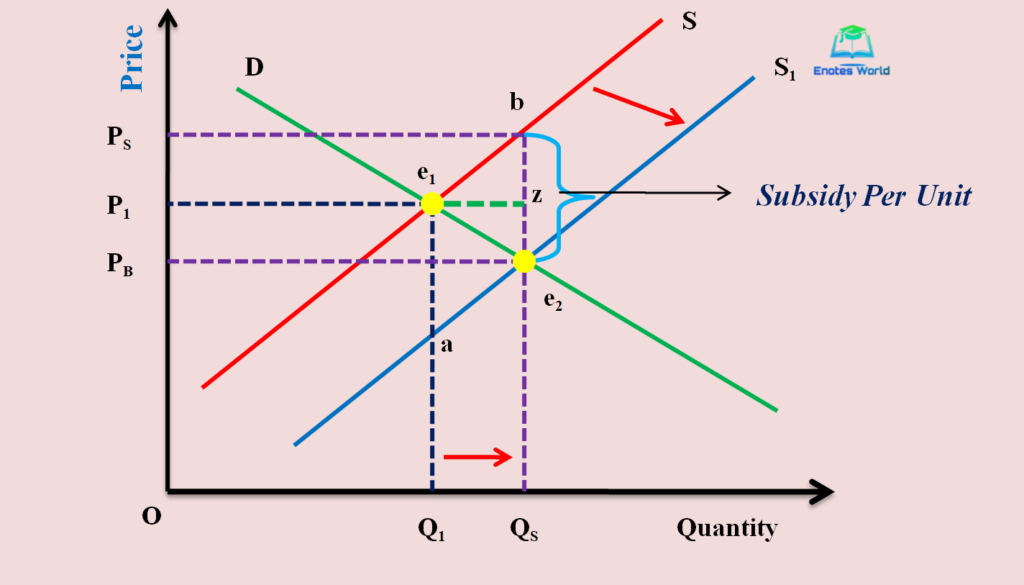

If a subsidy is provided to sellers of a particular product it will support or motivate them. With such support in the form of subsidy the supply curve shifts to the right such that market equilibrium quantity is increased. The subsidy to the seller is also known as a production subsidy. If we observe the overall effect of production subsidy, it can be treated as a negative tax. Thus the effect on production and price is just reverse to that of per unit tax or excise duty. The following figure shows the overall effect of the subsidy on the seller on market equilibrium.

In the above diagram, the demand curve D and supply curve S intersect to each other at point e1. The equilibrium price that the buyers paying and sellers receiving at that point are P1 and the equilibrium quantity is Q1. Suppose the government provides a subsidy to the sellers of the product then as a result supply curve shifts rightward from S to S1. The new supply curve intersects with the consumer demand curve (that remains constant) at point e2.

At the new equilibrium point, the price that buyers pay is PB and sellers receive is PS. The vertical gap or distance between the price sellers receives (PS) and the price that buyers pay (PB) is the per-unit subsidy. Here, after providing subsidy by the government, prices buyers pay and sellers receive are different and market shifts from point e1 to e2 and equilibrium quantity also increases from Q1 to QS.

Therefore, after the provision of subsidy to sellers, the following conclusion may be drawn;

- The new equilibrium price is less than the equilibrium price of the non-subsidies situation. That is PB.

- Price receives by the seller is the summation of the new equilibrium price and amount of subsidy per unit (PB+be2 or ae1).

- Subsidy by the government has created the difference between the price that buyers pay and sellers receive by the amount of subsidy.

- After subsidy to the producers, consumers pay fewer prices than before. Thus they are benefited by ze2. Thus the part of the subsidy goes to the consumers.

- The subsidy benefit to the sellers or producers is equal to bz. If we see the elasticity of demand and supply, it is almost equal so the subsidy shares by consumers and producers are also the same.

- Therefore we can conclude that the proportion of benefits that goes to the producers and the buyers depends on the elasticities of demand and supply. With the lower elasticity, the higher gains from subsidy and vice versa.

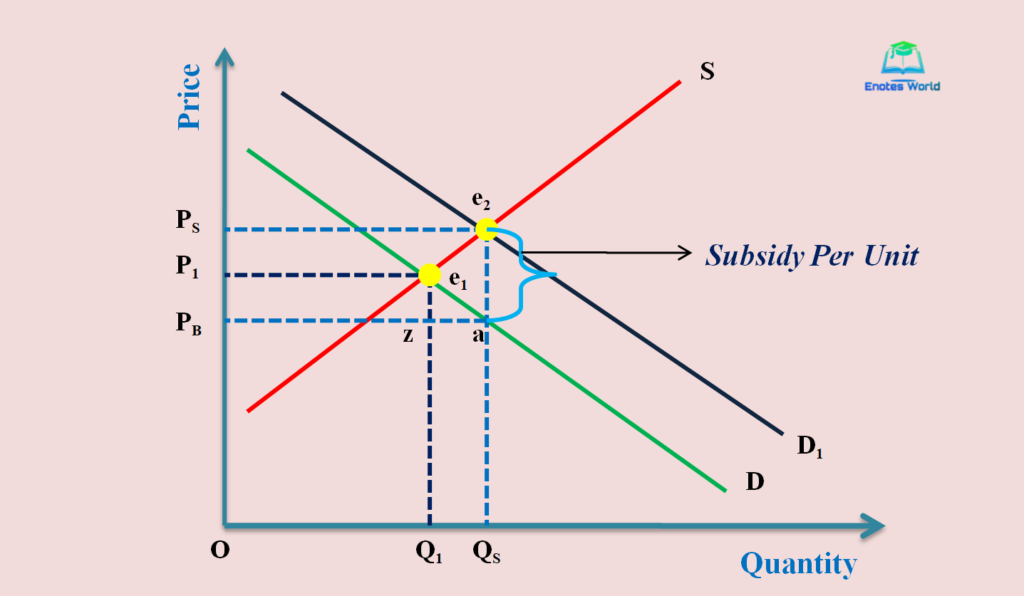

Case-II: Provision of Subsidy to Buyers of a Product

In this case, we will see the effect of subsidy by the government to the buyers of the product or the consumers. If the subsidy is given to the buyers they can afford more than previous and as a result the demand curve shifts towards right. With this, the equilibrium quantity in the market will also increase. The following figure shows the overall effect of subsidy to consumers on the market equilibrium.

In the above figure, the initial demand curve and supply curve intersect to each other at point e1. This is the pre-subsidy situation with price OP1 and quantity OQ1. The price receives by sellers and pays by buyers is similar in the pre-subsidy situation (OP1). Let us now suppose that a subsidy of e2a has granted to the buyers of the product. If the government provides a subsidy to buyers, the demand curve shifts to the right as D1 such that new equilibrium occurs at point e2. At a new equilibrium point, the price that buyers pay is PB and the price that sellers receive is PS. The gap between the price receives by sellers (PS) and the price pays by buyers (PB) is subsidy per unit to buyers.

Because of subsidy by the government the market moves from e1 to e2 with an increase in equilibrium price and quantity than equilibrium price and quantity of pre-subsidy state. Therefore, after the provision of subsidy to buyers, the following conclusion may be drawn;

- The new equilibrium price is more than the equilibrium price of the non-subsidies situation. That is PS.

- The price pays by the buyers is the deduction of the new equilibrium price and amount of subsidy per unit (PS-ae2).

- Subsidy by the government has created the difference between the price that buyers pay and sellers receive by the amount of subsidy.

- After subsidy to the buyers, consumers pay fewer prices than before. Thus they are benefited by ze1. The subsidy benefit to the sellers or producers is equal to P1PS. Thus the subsidy provided to consumers or buyers goes to the part of sellers as well.

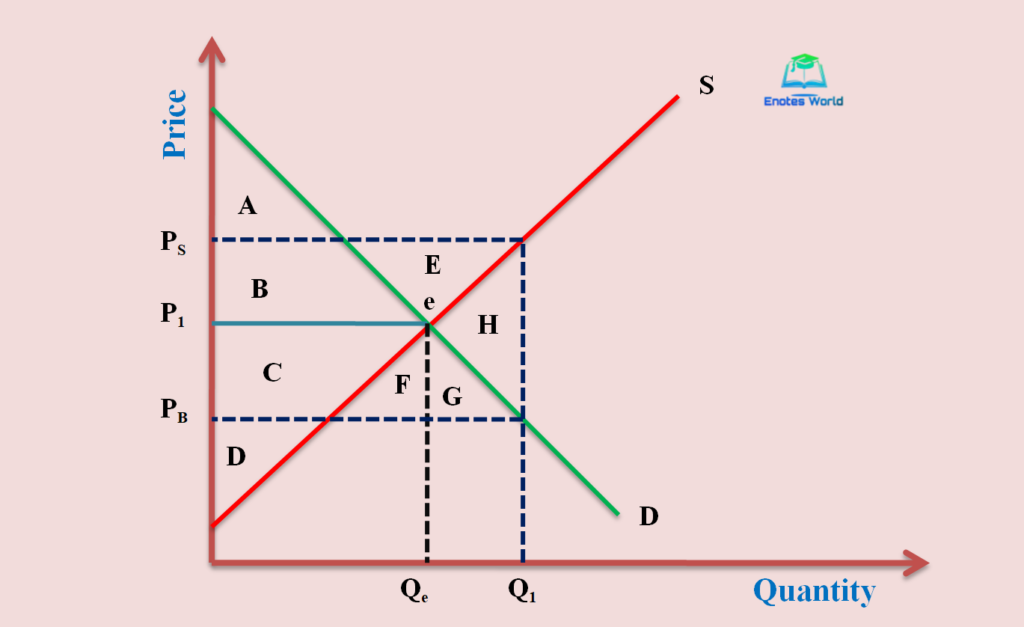

Implication or Effect of Subsidy in Market Equilibrium

If we compare both of the cases we can say that whether the same amount of subsidy is provided to sellers or buyers, the ultimate effect is the same. It means when the government provides a subsidy (either to the buyers or sellers) then the buyer pays less than pre-subsidy and the seller receives more. The following figure shows the ultimate effect of subsidy (either to consumers or buyers).

In the above diagram demand and supply, curve intersects with each other at point e. the establishment of new equilibrium is based on to whom subsidy has provided. If the subsidy is provided to consumers then the new equilibrium will establish by rightward shifts in the demand curve and if the subsidy is provided to sellers then rightward shifts in the supply curve will form a new equilibrium. As we already discussed above, the ultimate effect will not alter based on to whom subsidy has provided. Thus in the above diagram new equilibrium has not been drawn.

Now the following table presents the overall effect of government subsidy in market equilibrium.

| Title | Before Subsidy | After Subsidy |

| Subsidy | – | PBPS |

| Equilibrium Price | OP1 | – |

| Price Paid by Buyers | OP1 | OPB |

| Price Received by Sellers | OP1 | OPS |

| Equilibrium Quantity | OQe | OQ1 |

| Consumer Surplus | A+B | A+B+C+F+G (Gain by C+F+G) |

| Producers Surplus | C+D | B+C+D+E (Gain by B+E) |

| Government Expenditure or Subsidy | – | B+C+E+F+G+H |

| Total Surplus | A+B+C+D | A+B+C+D-H |

Note:

- Total Surplus Before Subsidy=Consumer Surplus + Producer Surplus

- Total Surplus After Subsidy=Consumer Surplus + Producer Surplus – Government Expenditure or Subsidy

Comparing the obtained information and values we get the following conclusions;

- Total surplus before subsidy is higher than that of after subsidy (A+B+C+D is greater than A+B+C+D-H),

- Deadweight loss= Burden to the government/Overproduction is H. It indicates that the enactment of subsidy policy will create a burden to the government more than the benefits obtained by the consumers from it.

Therefore the provision of government subsidy in the perfectly competitive free market results in the creation of deadweight loss and inefficiency in the market. The subsidy has thus a negative effect on the welfare of the consumer. But we also can say that the programs like subsidy are designed for helping the poor not for hurting the participants of the free market.

References and Suggested Readings

Dhakal, R. (2019). Microeconomics for Business. Kathmandu: Samjhana Publication Pvt. Ltd.

Dwibedi, D.N. (2003). Microeconomics Theory and Applications. Delhi: Vikas Publishing House Pvt. Ltd

Koutsoyiannis, A. (1979). Modern Microeconomics. London: ELBS/Macmillan.